Revology Analytics Insider

Browse Contents Based on Category or Topic

Filter by Category

Filter by Topic/Tag

- AI

- AI Pricing

- AI Transformation

- AI in Business Analytics

- AI/ML

- AI/ML Distribution

- ARPU

- Analysis with Python

- Analysis with R

- Analysis with Tableau

- Analytics Leadership

- Assortment Optimization

- Attribution Modeling

- B2B Pricing

- BATNA

- Bayesian Modeling

- Budget Optimization

- Business Growth through Pricing

- CPG

- CPG Pricing

- CRM Data Analysis

- Category Management

- Commercial Analytics Transformation

- Competitive Analysis

- Competitive Pricing

- Consumer Durables

- Consumer Electronics

- Consumer Products

- Cost Inflation

- Cross-Sell Optimization

- Cross-sell Opportunities

- Customer Analytics

- Customer Churn

- Customer Churn Modeling

- Customer Lifetime Value

- Customer Retention

- Customer Segmentation

- Data Analytics

- Data Monetization

- Data Visualization

- Data Warehouse

- Data-Driven Decision Making

- Data-driven Pricing

- Discount Management

- Distribution

- Distributor Data

- Distributor Profitability

- Durable Goods

- Dynamic Pricing

- Elasticity-Based Pricing Strategies

Subscribe to Revology Analytics Insider

Want to stay abreast of the latest Revenue Growth Analytics thought leadership by Revology?

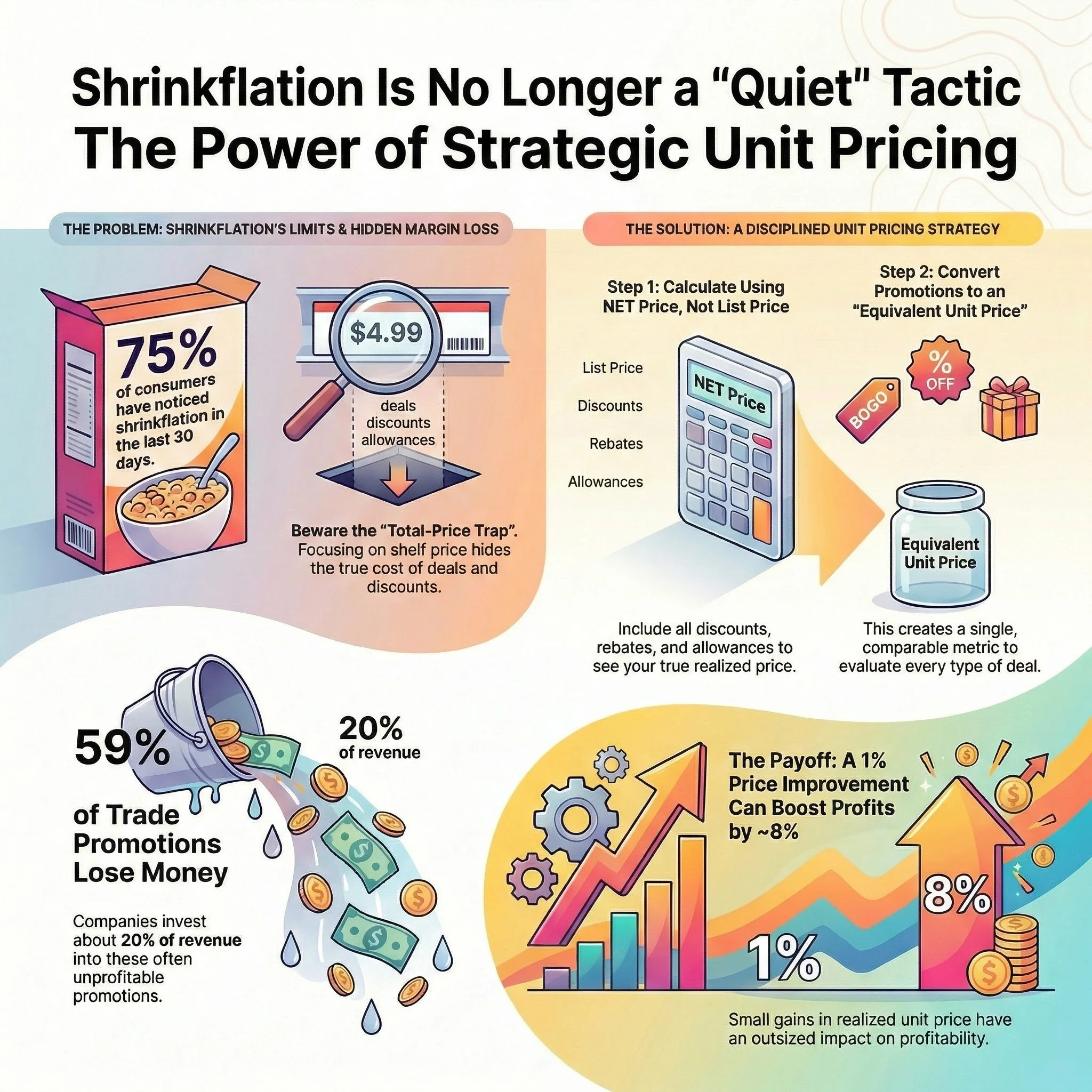

Unit Pricing: The Pricing Focus Leaders Use After Shrinkflation Hits Its Limit

Infographic showing the unit pricing formula (Net Price ÷ Base Unit Quantity) and how CPG leaders use equivalent unit price to spot margin leakage in promotions and pack architecture instead of using shrinkflation." (This expands on the source's suggested alt text: "unit pricing strategy example showing price per ounce across pack sizes" to include the specific context of the "unit pricing formula" and "shrinkflation".)

Competitive Analysis in 2026: Best Practices for Pricing and RGM Teams

Competitive analysis in 2026: best practices for pricing and RGM teams to track true competitor prices, CPI, and scenarios without margin leaks.

Taking Pricing (and Profits) to the Next Level – The Current Landscape

More than 225 organizations (from global leaders like 3M, L’Oréal, Nestlé, Philips, Best Buy, and Johnson & Johnson to mid‑market companies) have completed our Revenue Growth Analytics Scorecard across four capabilities: Sales & Marketing Enablement, Pricing & Profitability Strategy, Pricing Analytics & Optimization, and Promotion Analytics & Optimization.

In this executive briefing, Armin Kakas, our Revology Analytics founder and Managing Partner, and Pricing & RGM Partner Enrico Sieni will unpack the 2025 Revenue Growth Analytics Maturity Report and show exactly which capabilities to build first to move from Medium to High maturity in 90 days.

Why RGM Platforms Fail the Mid-Market (And How Expert-Led RMaaS Solves the Adoption Trap)

Mid-market companies struggle to realize ROI from traditional RGM platforms because these tools act like X-Rays, diagnosing thousands of margin leaks without offering the surgical guidance needed to fix them. This creates an "Adoption Trap" where teams are paralyzed by data overload and long implementation timelines, leaving them unable to turn insights into persistent profitable behaviors. The article advocates for Expert-led Revenue Management as a Service (RMaaS), a hybrid model that pairs technology with human expertise to deliver prioritized, actionable wins in days rather than months.

The Executive’s Guide to Surge Pricing and Dynamic Pricing Models

While many executives associate surge pricing with Uber or airlines, its real untapped potential lies within B2B industries still reliant on static, annual price lists. This guide unpacks how dynamic pricing models move beyond "cost-plus" formulas, allowing businesses to respond intelligently to market shifts, protect margins from volatile costs, and capture otherwise lost revenue. From manufacturing and distribution to retail, learn how to leverage your data to implement a pricing strategy that boosts profitability and agility.

AI Won’t Fix Your Pricing Strategy. This Will.

While many leaders are seduced by the promise that a sophisticated AI tool can solve their pricing problems, this illusion of innovation is a dangerous trap. A fancy algorithm will never substitute for a sound, human-led strategy, a solid data foundation, and strong commercial execution. Lasting success comes not from outsourcing your thinking to a black box, but from building a durable, in-house capability that empowers your team to win.

How Strategic Price Customization Recaptures Value

The most dangerous threat to profitability isn’t a market crash but the silent erosion of margin from a flawed pricing structure. Most companies unknowingly lose over half of their intended price increases to a "leaky waterfall" of unchecked discounts, rebates, and ad-hoc sales overrides. This article provides a blueprint for building a data-driven, value-based pricing engine to plug these leaks and transform pricing into your most powerful lever for growth.

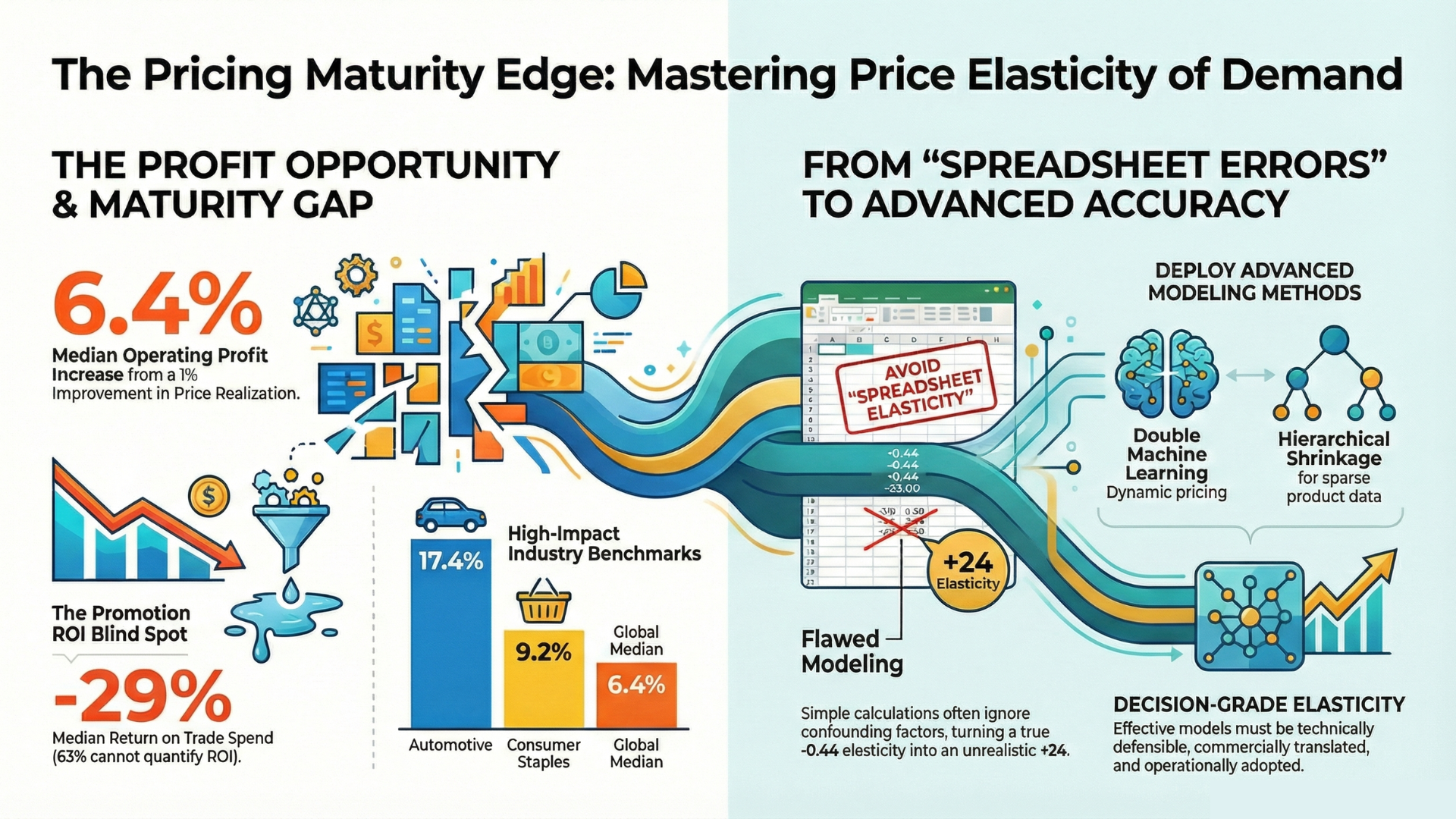

Revenue Growth Analytics Maturity in 2025: Why Pricing Punch Still Matters, and How to Land It

Revology's 2025 Revenue Growth Analytics (RGA) Maturity Scorecard confirms pricing is still the most powerful profit lever, but its impact is uneven and difficult for most organizations to capture. Our latest report reveals that 50% of companies remain at a 'Medium' maturity level, with significant gaps in promotion ROI and sales enablement analytics that consistently leak value. This article breaks down the four pillars of RGA and provides actionable 90-day playbooks to help leaders close the execution gap and translate price potential into realized profit.

Tariffs, “Sneakflation,” and the Pricing Tightrope

A hidden tariff tax, dubbed "sneakflation," is quietly raising prices on everyday goods and squeezing business profits. Faced with this pressure, many companies make the mistake of implementing blunt, across-the-board price hikes that can damage sales volume and customer relationships. This post details a smarter, surgical approach, using data-driven strategies like price elasticity analysis and scenario modeling to manage rising costs. Learn how to walk the pricing tightrope to protect your margins without alienating your customer base.

The Distributor’s Playbook for Growing Share of Wallet

Distributors are unknowingly losing profit from their best accounts due to blind spots in pricing, discounting, and product mix. Traditional sales reports can't detect this slow drain, allowing significant cross-sell opportunities and margin to go untapped. Guided purchase intelligence offers a disciplined framework, combining smart analytics with sales activation to systematically identify and recapture this hidden value. This playbook provides a step-by-step guide to grow your share of wallet and build a more resilient, profitable business.

How Hidden SKU Profitability Is Dragging Down Your Distribution Business (And How to Fix It)

Are you seeing revenue climb while margins get squeezed? Your distribution business is likely caught in the "Portfolio Trap," where high-volume but unprofitable SKUs secretly drain your bottom line. This article diagnoses the problem, revealing how a lack of granular data and reliance on outdated pricing models hide the true costs eroding your profits. Discover how to fix this by focusing on SKU profitability, enabling you to identify and manage these hidden drags to drive real financial growth.

The $1 Trillion Blind Spot: Why Most B2B Promotions Destroy Profit

What if your biggest sales driver was also your biggest profit drain? For most B2B companies, this is the hidden reality of their trade spend, where a lack of true promotion trade optimization allows margin-destroying activities to hide behind impressive-looking sales lifts. This article exposes the common fallacies—from the "top-line lift" trap to cannibalization blind spots—and provides an analytics-driven framework to turn your promotional budget from an unmanaged expense into a strategic growth investment.

What is Your True Net Price? The Ultimate Guide to B2B Commercial Psychology & Profit Realization

While companies obsess over list price, our research shows the average business systematically dismantles its own profitability from within. The real battle is won or lost in the price waterfall—the chasm between list price and the final pocket price where discounts, rebates, and allowances silently erode margin. Achieving optimal net price realization requires moving beyond siloed commercial psychology and spreadsheet chaos to a unified strategy that stops profit leakage at its source. This guide provides the framework to reclaim that lost margin by focusing on the one number that truly matters: your True Net Price.

Help! The Customer is Walking, Drop The Price!

When a key customer threatens to leave over price, the immediate instinct is to offer a discount to save the deal. However, this reactive approach is a trap that devalues your offering and fails to fix the real root causes, which are often a series of unaddressed service and operational failures. Learn a strategic framework to diagnose the true source of dissatisfaction and negotiate a solution that strengthens the partnership while protecting your profitability.

Stop asking for an "AI Pricing Tool."

For B2B firms in industries like wholesale, distribution, and manufacturing, the idea that AI in pricing is a magic black box can quickly become an investment sinkhole and a strategic dead end. Before thinking about AI, you must confront the two beasts that kill nearly every pricing initiative: Cross-Functional Chaos and The Profitability Mirage. Fancy algorithms do not drive pricing success—getting the basics right is.

The Role of Pricing & RGM In Managing Customer Churn

B2B customer churn can silently cripple growth, but many companies overlook its impact and fail to predict it effectively. This blog reveals how embracing proactive, data-driven strategies, especially through Pricing & Revenue Growth Management (RGM), can transform your approach from reactive damage control to strategic, profitable retention. Discover how advanced analytics can help you identify churn risks, optimize pricing, and unlock hidden growth opportunities, safeguarding your P&L and empowering your sales teams.

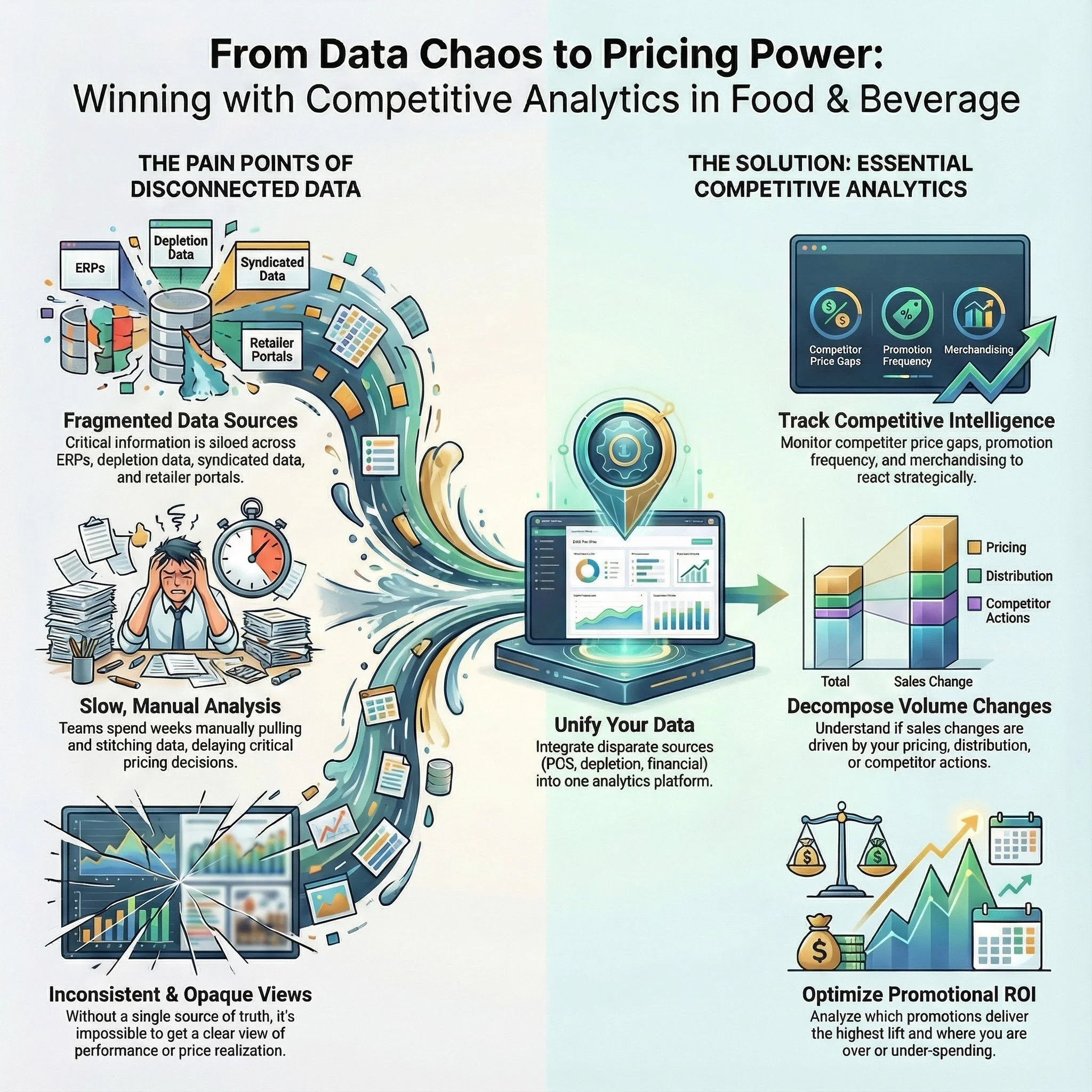

Why Your CPG Needs an Integrated Pricing & RGM Navigator (And Why It Beats Turnkey Solutions)

Mid-market CPGs are struggling to make profitable decisions due to data scattered across disparate internal and external systems. This fragmentation leads to significant margin erosion, reactive strategies, and a costly dependency on rigid, turnkey analytics solutions that fail to provide a complete picture. By embracing an integrated and owned Pricing & RGM Navigator, companies can unify their data, unlock predictive insights, and build true organizational capability. This empowers teams to move from reactive "fire drills" to a proactive, commanding position in the market.

The Tariff Tightrope: Why Walmart's Price Hikes Signal a Reality Check for American Consumers

Walmart's recent announcement of price hikes due to tariffs serves as a stark reality check, confirming that American consumers will ultimately bear these costs. This isn't just about Walmart; it signals a broader economic shift impacting shoppers and presenting significant challenges for CPG companies. This article delves into why these price increases are happening and outlines crucial strategies for CPGs to navigate this turbulent environment.