Help! The Customer is Walking, Drop The Price!

Why Dropping the Price is the Worst Way to Save a Customer

It’s one of the most familiar scenes in business. A key account, once a cornerstone of your portfolio, is threatening to leave. The reason given is “price”. The demand from your sales team is immediate and absolute: we must slash our price, or we lose them. The most common reaction—the panicked, last-minute price cut—provides a sigh of relief, “the customer is saved”, but the root causes that triggered the emergency, as well as the remedy are just short term fixes.

Using this approach repeatedly, trains your sales team as well as your customers to leverage this tactic across many type of situations. Unfortunately, It is a policy that systematically dismantles your gross margin and devalues your offering. So why are companies constantly falling into this trap, even when they realize both the short and long term dangers of these actions?

The root causes

The plea for a lower price is almost never the real story; it is the final, explosive symptom of a deeper, chronic illness within the relationship. Sure, the short term price cut can provide the dying patient with a potent painkiller, but it doesn’t solve the actual disease.

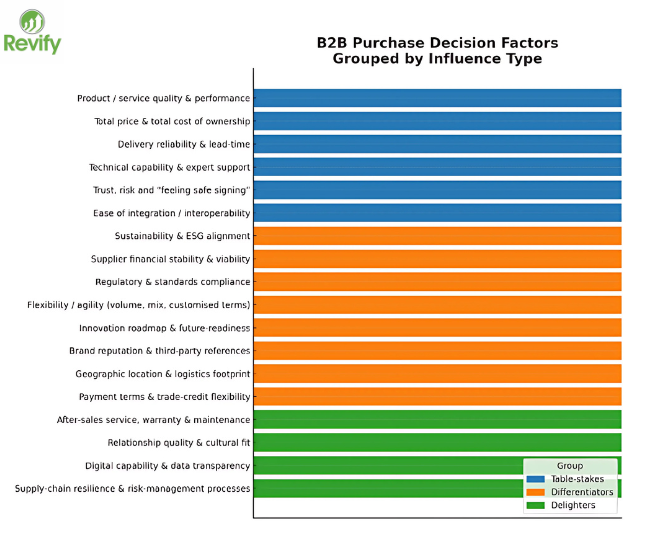

When a B2B relationship sours, price is often the first reason cited for a departure. It’s simple, quantifiable, and an easy justification for the customer to give and the sales rep to relay. However, extensive research and decades of in-the-trenches experience tell a different story. Price is rarely the primary driver of customer churn. More often, it ranks somewhere between the second and fifth reason a customer chooses to switch suppliers. The real culprits are typically a series of smaller, unaddressed operational and service failures that have compounded over time.

Think of it as a death by a thousand cuts. The relationship didn't collapse overnight. It eroded slowly, through things like:

Persistent Supply Chain and Logistic Failures: A string of late deliveries or incomplete orders that disrupt the customer’s own operations.

Invoicing and Administrative Errors: A consistent pattern of incorrect invoices that require tedious back-and-forth to resolve, creating friction and frustration.

Lack of Proactive Service: A relationship that has become purely transactional, with no strategic guidance, check-ins, or perceived partnership.

Poor Communication: A failure to inform the customer about price changes, product updates, or potential disruptions, making them feel like an afterthought.

Even for loyal customers, such events potentially open the door for competition to pitch their case. Subsequently, over time, a company’s value proposition is fatally eroded and the customer will lose trust. Once that milestone is passed, it is very difficult (and often expensive) to retain that business.

By the time the customer brings up price as the remedy, their trust has already been shattered and the relationship has been boiled down to a purely transactional one. The competitor’s offer isn't the cause of their departure; it’s simply the final, convenient exit ramp. They are using price as a lever because the underlying value of the relationship has already deteriorated. The conversation isn’t really about saving 10%; it’s about their frustration finally boiling over and seeing how much of that lasting relationship is worth to you.

It’s unfortunate the crisis couldn’t be averted earlier. As we’ve discussed in our previous work on The Role of Pricing & RGM In Managing Customer Churn, a proactive system of monitoring customer health, such as a robust RFM (Recency, Frequency, Monetary) analysis, can flag these issues long before they reach a boiling point. A sudden drop in order frequency or size is a clear signal of distress that a data-driven organization would catch and act on, transforming a potential crisis into a retention opportunity.

The Downward Spiral of Panic Discounting

Let’s be clear: yielding to a last-minute price cut is often the worst possible fix. It’s a tactical blunder with three devastating consequences that ripple through the business.

First, it’s a temporary Band-Aid on a gaping wound. A discount does nothing to fix the systemic issues that led to the customer’s dissatisfaction. If their deliveries are still late and their invoices are still wrong, they will remain an unhappy customer—you’ll just be serving them at a lower margin. The reprieve is temporary, and the root causes will continue to fester until the next crisis. It also teaches your Sales team that it’s ok to sacrifice price, even though you are not getting anything additional in return from the customer: it’s the same volume, same terms, just lower price, which means less sales and less margin. These entrained behaviors are quite noticeable when we work with clients that have a fairly inexperienced or untrained sales force: if a salesperson does not have a strong grasp on how to “value sell”, they will most likely leverage price to win and retain business.

Second, it permanently anchors your value lower. You have just taught this customer—and by extension, your sales team—that the path to a better price is to threaten leaving. The next time a contract is up for renewal, what do you think their first move will be? This behavior sets a dangerous precedent, devaluing your product and transforming your relationship from a strategic partnership into a transactional price negotiation. It fundamentally damages future customer lifetime value (CLV) and keeps you constantly fighting to retain existing customers. For years, a European construction products distributor inadvertently trained its customer base to expect significant discounts at the end of each quarter. These price reductions were offered to meet quarterly sales targets. Consequently, customers learned to delay their orders, anticipating better pricing as the quarter drew to a close.

Finally, it poisons your customer portfolio. There’s a foundational truth in this business: customers retained on price will eventually be lost on price. By competing solely on cost, you are actively cultivating a customer base that is disloyal and price-sensitive. You discard the loyal, high-margin partners who value your service and reliability in favor of transient, high-maintenance accounts who will jump to the next competitor who dangles a shinier, cheaper offer. It’s a guaranteed recipe for long-term margin erosion. In addition, savvy customers will proactively work on lowering the cost of switching between vendors, ensuring that two or more vendors will always be fighting for the volume at stake and shift purchase orders between competitors to get the best prices.

The stark contrast between a reactive and a strategic response becomes evident when laid out side-by-side.

From Firefighter to Architect: A Strategic Framework for Response

Instead of asking, “How much do we need to lower the price?”, the right response is to pause and ask a series of diagnostic questions. This requires shifting from a reactive, emotional posture to a proactive, data-driven one. It’s here that a dedicated Revenue Growth Management (RGM) analytics platform becomes your indispensable central nervous system.

Step 1: Consult the Data — Establish the Objective Viewpoint Before engaging in any conversation, you need objective clarity. The sales rep’s panic is not data. A modern analytics platform or a disciplined internal process should be your first stop. Look beyond revenue to a holistic set of metrics:

Customer Profitability: Are they actually a profitable account when you factor in their specific discounts and high cost-to-serve?

Strategic Importance to Portfolio: How critical is this customer within the broader portfolio? If we let the customer walk, can there be broader implications for other customers? (e.g. customer’s visibility in the marketplace, issues with their mother company, etc.).

Peer Group Pricing: How is this customer priced relative to other customers of a similar size, purchasing behavior, and region? Are they already receiving a favorable price?

Service Level Metrics: What is their objective history? Pull the reports on on-time-in-full (OTIF) delivery rates, invoice accuracy, and the number of support tickets logged.

Customer Lifetime Value (CLV): What is their long-term potential vs. their current transactional value?

Arming yourself with this data completely changes the tenor of the internal and external conversation. It moves the discussion from surrender to a fact-based analysis and prevents you from negotiating against yourself.

Step 2: Engage to Diagnose — The Power of the Human Connection With facts in hand, the next step is a strategic conversation. This is not a negotiation; it is a consultative investigation. Consider having a senior manager or a customer success lead—someone perceived as a neutral problem-solver—initiate the call. The goal is to demonstrate empathy and a genuine desire to understand. Structure the conversation carefully:

Open with Empathy: "I was concerned when I heard you were considering a change. Your partnership is important to us, and I wanted to connect personally."

State the Goal Clearly: "My objective today isn't to talk about price. It's to listen and truly understand your experience working with us over the past year."

Ask Open-Ended, Diagnostic Questions:

To understand operations: "Can you walk me through the journey of one of our products, from the moment you order it to the moment you use it? Where are the friction points for your team?"

To understand the partnership gap: "In an ideal world, what would a strategic partner in our space be doing for your business that we currently aren't?"

To understand future goals: "As you look ahead at the next 12 months, what are your biggest challenges or objectives? How could your suppliers better help you achieve them?"

Review Your Internal Assessment of the Customer: Ask within your organization how well is the customer adopting your processes and terms. Do they pay on time? Do they often bypass standard processes, pushing for exceptions? Do they tend to abuse certain shared services (e.g. technical or customer service)?

Listen more than you talk. Document their feedback meticulously. This process itself is a powerful act of value creation. You are demonstrating a level of engagement that the competitor, with their simple low-ball offer, likely cannot match.

Step 3: Engineer a Better Deal — The Art of the "Give-to-Get" After a thorough diagnosis, a commercial concession may still be a necessary part of the solution to salvage a valuable, long-term relationship. However, it must never be a unilateral surrender. Any "give" from your side must be met with a "get" from theirs. This reframes the price cut as a strategic investment with a tangible return. Turn the defensive crisis into an offensive growth opportunity by expanding the negotiation beyond a single price point.

The "Get" Could Be Increased Share-of-Wallet: "We can explore better pricing on Product A, but that would be contingent on you consolidating your spend on Product B and C with us."

The "Get" Could Be Volume or Term Commitments: "We can offer a volume-based rebate, but that would require a larger annual commitment and a two-year contract extension. Does that work for you?"

The "Get" Could Be Operational Efficiency: "We can offer a 2% credit if you switch to our automated electronic invoicing and a standardized ordering schedule, which would lower our shared administrative costs."

The "Get" Could Be Marketing and Advocacy: "We are prepared to make this investment in our partnership. In return, would you be willing to partner with us on a case study or serve as a reference account once we've demonstrated improvement?"

This "give-to-get" approach transforms the conversation from "Can you do it cheaper?" to "How can we create more value for each other?" It positions your team as creative problem-solvers, not just discount-givers.

The Art of the Concession: Architecting a Win-Win

Let’s be pragmatic. In some situations, after a thorough diagnosis, a commercial concession may be necessary to salvage a valuable, long-term relationship. However, it should never be a unilateral surrender. A price cut must be reframed as a strategic investment, and every investment should have a return.

This is not about dropping the price; it’s about engineering a better deal. The guiding principle should be: if we are going to invest marginally in this relationship, what new value are we getting in return?

This is where you turn a defensive crisis into an offensive growth opportunity. The conversation becomes a negotiation for mutual benefit.

"If we can work on the pricing for Product A, can you commit to giving us 100% of your business for Product B, which you currently split with a competitor?"

"We can explore a volume-based rebate, but that would require a larger annual commitment from you. Are you open to consolidating more of your spend with us?"

This approach requires your team to see the full picture of the customer's potential. An RGM platform with a sophisticated cross-sell module, such as Revify Analytics’, is instrumental here. It can instantly analyze the customer's purchasing patterns and identify the most logical and profitable whitespace opportunities. It turns a retention call into a strategic growth conversation, arming your sales team with a data-backed proposal that expands the relationship while securing it. This transforms the salesperson from a simple discount-giver into a true portfolio manager, architecting profitable growth in every account.

Conclusion: Building a Culture of Commercial Resilience

The panicked call from the sales floor is a litmus test for your entire commercial culture. A reactive culture defaults to the easiest lever—price—and erodes profitability one "emergency" at a time. A resilient, proactive culture sees that moment for what it is: a signal of a deeper failure and an opportunity to strengthen a relationship through genuine problem-solving.

Escaping the downward spiral of panic discounting requires a fundamental shift in mindset, process, and technology. It demands a commitment to understanding the root causes of customer dissatisfaction, a disciplined approach to data-driven diagnosis, and the strategic courage to negotiate for value rather than surrender on price. By architecting your customer retention strategies around insight and partnership—not fear and concessions—you move beyond simply saving at-risk accounts. You begin to build a portfolio of loyal, profitable customers who stay not because you are the cheapest, but because you are their most valuable partner.

Take the Next Step from Diagnosis to Action

Knowing you should diagnose the root cause before offering a discount is one thing. Having the time and the data to do it when a key account is threatening to walk is another story entirely. It's a classic case of knowing the right path but being stuck on the wrong one by the pressure of daily operations.

If you’re leading a team at a manufacturing or distribution company, you live in this pressure cooker. You’re trying to protect margins while your team navigates thousands of SKUs, volatile costs, and price exceptions often managed by a prayer and a spreadsheet. It’s tough to ask your sales reps to hold the line on value without giving them the concrete data to back it up.

That’s precisely the gap our Revify’s Revenue Growth Management as a Service (RGMaaS) model is built to fill. We combine the analytical horsepower of a sophisticated platform with the practical, hands-on guidance from pricing experts. Think of it less as buying software and more as getting a dedicated analytics partner who helps you find the right answers, fast—usually within a couple of weeks. This approach means you can finally get a data-driven gut check on how an at-risk customer is priced or pinpoint the real “size of the prize” in a potential cross-sell deal.

The best way forward is often the most pragmatic one. We invite you to have a conversation with us about your business. Through a quick onboarding process, followed by a consultative diagnostic session, we can dive into your data together to give you a clear, immediate view of where you might be leaving money on the table.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.