How Strategic Price Customization Recaptures Value

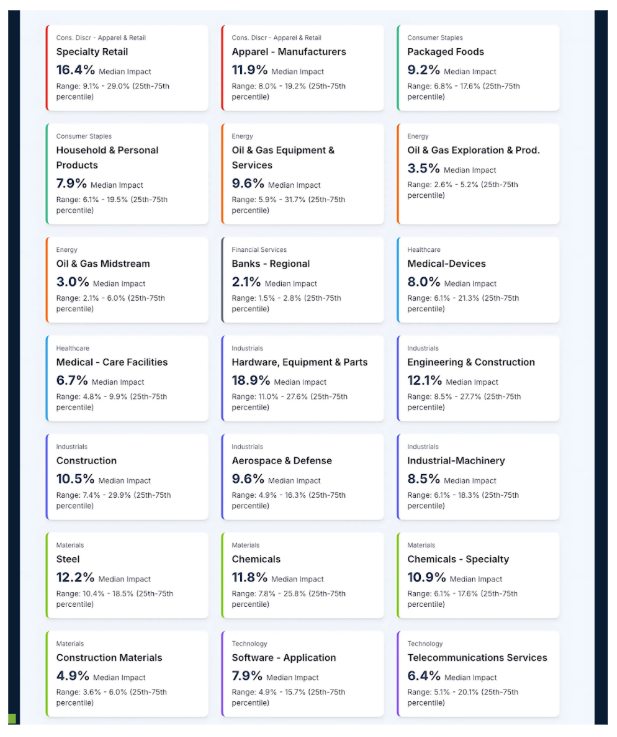

The most dangerous threat to profitability in distribution, manufacturing, and retail isn’t a sudden market crash – it’s the slow, silent erosion of margin within the pricing structure. While most executives focus on volume and cost-cutting, they often overlook the immense power of pricing (essentially strategic price discrimination to capture customer value). A recent analysis by Revology Analytics of nearly 2,000 companies confirms that a 1% improvement in net price realization yields a median 6.4% increase in operating profit. In industries like Automotive, the leverage is staggering – up to 17.4% profit increase – and 9.2% for Consumer Staples, highlighting that pricing remains the single most potent financial performance lever for many businesses. For wholesale distributors, the effect is often 10–12% profit gain per 1% price increase. In short, getting price right beats any other improvement effort in its impact on the bottom line.

Sub-industry deep dive of a +1% Net Price Realization on Operating Profit $. (Source: 2025 Revenue Growth Analytics Maturity Report)

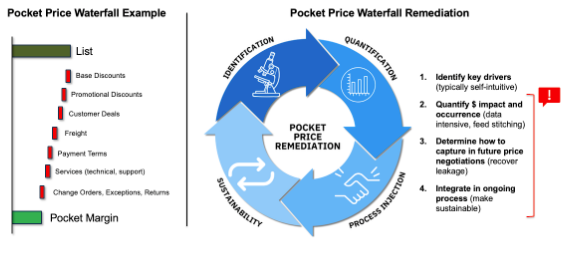

Yet despite this extraordinary leverage, most companies fail to actually capture the prices they intend. A landmark Simon-Kucher global pricing study found that companies on average only realize about 50% of their planned price increases after accounting for all discounts, rebates, and concessions[3]. This staggering statistic reveals a painful truth: for every dollar of intended price uplift, more than fifty cents vanishes into a complex web of unchecked discounts and allowances. This is the “Leaky Pricing Waterfall” in action. Your list price sits at the top, but as the price cascades through on-invoice discounts, off-invoice rebates, free add-ons, and freight costs, the revenue “water” leaks at each step. The final pocket price – what you actually collect – is often just a fraction of your list price. Compounding this issue, over half of companies (about 50.7%) don’t even have a price waterfall analysis in place to track these leaks, operating with a massive blind spot where profit is dripping away.

A conceptual “Pricing Waterfall.” As price flows from the initial list price through various on-invoice and off-invoice deductions, the pocket price (what the company actually pockets) shrinks dramatically. Identifying and plugging these leakage points is critical to prevent margin erosion.

Why Your Pricing Waterfall Is Eroding Your Margin

This profit erosion isn’t random – it occurs at predictable points in your commercial process, often masked by top-line revenue growth. Understanding where these leaks spring from is the first step toward plugging them, transforming your pricing structure from a source of loss into a powerful engine for growth. Here are the four most common leak points:

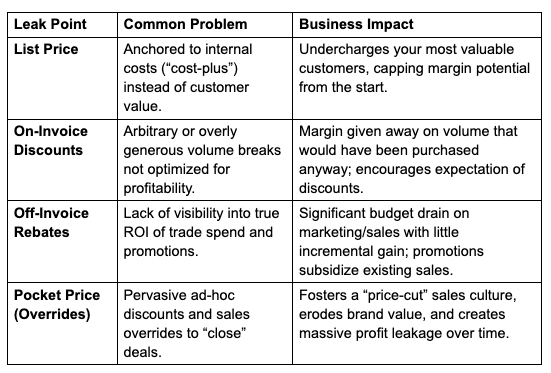

The List Price

The first and most significant leak often originates at the very top: your initial List Price. Too often, list prices are set based on internal costs or simplistic cost-plus formulas instead of true customer value. The 2025 Revenue Growth Analytics Maturity Report shows that while 56.4% of companies are trying to move in the right direction – setting specific pricing goals for different customer or product segments – these efforts are often superficial. Only 24% of companies determine their prices by using a sophisticated, value-based assessment for each market segment. In stark contrast, the remaining ~75% continue to rely on simpler, less-differentiated methods (a basic cost-plus or competition-based approach, or even purely subjective judgments). When your list price is anchored to your costs instead of your customer’s perceived willingness-to-pay, you place an artificially low ceiling on your profit potential before the first negotiation even begins. In effect, you are systematically undercharging your most valuable customers and leaving money on the table from day one[4].On-Invoice Discounts

On-invoice discounts – like volume price breaks or early-payment discounts shown directly on the invoice – are frequently granted based on historical norms and gut feel rather than data-driven analysis. The conventional wisdom that “higher volume always deserves a steep discount” is often a dangerous oversimplification. Without an optimized discount curve that models true profitability, you may be over-subsidizing your largest customers at your own expense, giving away margin on volume that those customers would have purchased anyway at higher prices. In other words, excessive quantity discounts reward business you would likely have won regardless, effectively a habit that corrodes value instead of a strategic incentive. This unchecked discount habit can quietly eat into margins deal by deal, especially when sales reps have broad latitude to offer discounts without clear guardrails.Off-Invoice Rebates

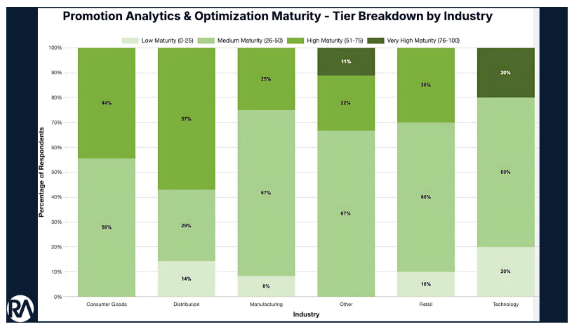

Next comes the deluge of off-invoice rebates and promotional allowances – often the most significant and least understood leakage area. These are discounts and funds that don’t show up on the invoice but are paid later (think quarterly volume rebates, co-op marketing funds, promotional bill-backs, etc.). Billions are spent on trade promotions with little visibility into their true ROI. In fact, over 60% of companies admit they cannot accurately quantify the return on their trade promotions. This means you are likely funding promotions that merely shift volume around (from one week or region to another) or subsidizing sales that would have occurred anyway. Without rigorous analytics, this rebate spend becomes a black hole – draining marketing and sales budgets with little to show for it. Worse, it conditions customers to expect continuous “special” discounts, making it hard to ever reclaim that value. Every dollar funneled into poorly monitored rebates is profit leaking out of your waterfall unchecked.Sales Overrides and Culture: Death by a Thousand Cuts

Finally, after list price, on-invoice discounts, and off-invoice rebates, we reach the last leak point: ad-hoc sales overrides that further erode the pocket price. A well-intentioned sales rep might offer an extra concession at quarter-end to close a deal (“just this once”). While each instance may be individually justifiable, these small last-minute discounts accumulate into millions in lost profit annually – the proverbial death by a thousand cuts. Even more dangerously, this fosters a culture where price is seen as the primary lever to win business. Over time, a “discount-to-win” culture trains your sales team and customers alike that your stated prices are flexible and that your product’s value is secondary to its price. This commoditizes your brand, erodes customer perception of value, and creates a vicious cycle of margin leakage that is hard to break.

Promotion Effectiveness maturity remains stalled across most industries, with very few organizations reaching the Very High tier. (Source: 2025 Revenue Growth Analytics Maturity Report)

To summarize these leak points and their impact:

A Blueprint for a Value-Based Pricing Engine

Reversing this trend of leakage requires moving beyond the limitations of spreadsheets, habits, and instinct. It demands a systematic approach to re-architect your entire pricing methodology – essentially building an in-house value-based pricing engine. The journey from pricing chaos to clarity involves three key steps, each grounded in data and designed for practical commercial action.

Step 1: Establishing a Causal Data Foundation

The bedrock of any robust pricing strategy is an integrated, trustworthy data foundation. For most companies, transactional, customer, and product data sit in disconnected silos – ERP systems, CRMs, sales databases – making it hard to get a full picture of what’s happening with prices and margins. The first practical step is to combine these sources into a unified view and analyze them at the granular transaction level. This means knowing, for each deal: what was the list price, what discounts/rebates were applied, and what pocket price was realized, along with contextual data (customer segment, product attributes, sales rep, etc.).

However, true transformation happens when we move beyond just seeing what happened to understanding why it happened. This is where advanced causal analytics and machine learning come in. Standard historical analysis might show a correlation like “sales are highest when our biggest discount is active” – leading to the flawed conclusion that the discount caused the sales spike. A causal model, however, can control for other factors (seasonality, competitive moves, underlying demand trends) to determine whether the discount actually caused the volume increase or simply coincided with it. This distinction is everything. By establishing a causal data foundation, we eliminate guesswork and build pricing strategies on a defensible, fact-based understanding of what truly drives customer behavior. This foundation reveals where pricing leaks are occurring and sets the stage for designing targeted solutions rather than knee-jerk reactions.

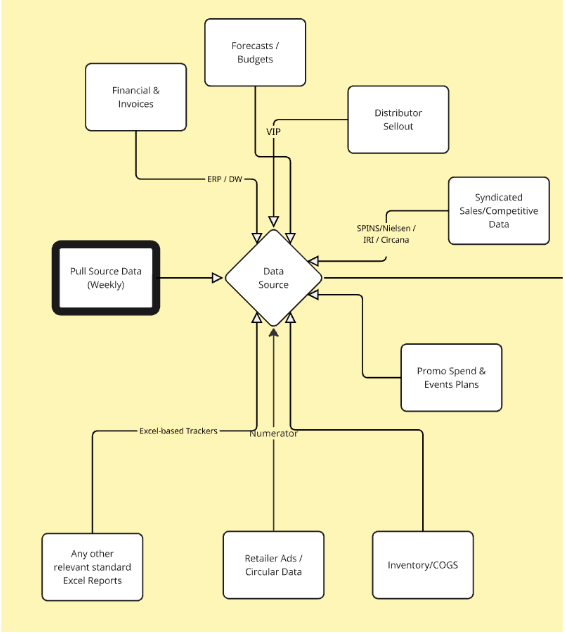

A simple illustration of what an integrated / harmonized Pricing Analytics Data Hub may look like for a Consumer Products company.

Step 2: Architecting the Price Customization Framework

With clear, causal insights in hand, you can design an intelligent pricing framework that aligns price with value on every transaction. This involves deploying a multi-tiered segmentation and price differentiation strategy – what pricing experts Dolan and Simon famously call “price customization” – to capture more of the total profit potential in your market. In economics terms, this is structured price discrimination: charging different customers different prices for the same product, in a way that reflects their willingness-to-pay and the value they receive. The goal is to minimize two classic sources of lost profit in one-size-fits-all pricing:

· Passed-Up Profit – customers who would have paid more than your current price, but never got the chance because your price was set too low for them.

· Money Left on the Table – customers who would have paid more (i.e. had higher willingness-to-pay) but instead get to pay your single low price and pocket the surplus value.

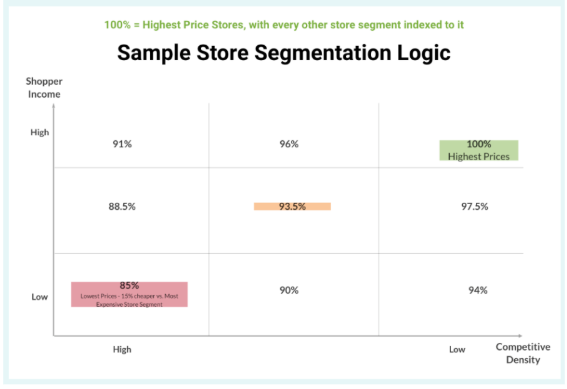

A simple segmentation approach in Automotive Retail - optimizing part-markups based on store cluster income levels and competitive density (both proxies for price sensitivity).

An intelligent customization framework recaptures this value by building “fences” that segment customers and transactions, ensuring each pays an appropriate price. This isn’t about making an overly complicated price list; it’s a dynamic structure that adapts prices based on context. There are four primary mechanisms (fences) to sort customers or transactions for targeted pricing:

Product-Line Sort (Good-Better-Best) – Offer tiered versions of your product at different price points. For example, Kodak famously used a “Good-Better-Best” strategy for film (Funtime, Gold, and Royal Gold), letting customers self-select into quality tiers at different prices. This captures higher willingness-to-pay for premium versions while still serving price-sensitive buyers with a basic version. Product versioning and bundling are classic forms of second-degree price discrimination that extract more value by varying the product offer alongside price.

Controlled Availability – Selectively offer discounts or special prices through specific channels, times, or to targeted groups so that only the most price-sensitive customers access them. This includes things like limited-time coupon codes, region-specific sales, or secret tier pricing for certain customer groups. By controlling availability, you can give a lower price only to those who truly need it to buy (and would not purchase otherwise) without cutting price for everyone. This fence uses self-selection and timing (a form of price discrimination that encourages bargain-hunters to identify themselves).

Sort on Buyer Characteristics – Differentiate prices based on observable customer traits that correlate with willingness-to-pay. For instance, offer discounted student or senior pricing, or industry-specific pricing (e.g. academic institutions vs. corporate buyers). Software companies might price differently for nonprofit organizations. This is essentially third-degree price discrimination – segmenting by customer demographic or type – and it ensures each segment is charged in line with the value they derive. As long as these differences are seen as fair (and legally permitted), this can boost profit and still maintain customer goodwill.

Sort on Transaction Characteristics – Vary price based on factors like purchase quantity, timing, or format of the sale. Common examples: volume-based pricing (discounts for buying more units), early-bird discounts for purchasing before a certain date, or charging different prices for bundles versus individual items. Selling a software suite at a lower combined price than the sum of individual modules is one way to encourage a larger purchase. These practices (like volume discounts or advance purchase discounts) are another form of second-degree discrimination – giving customers a lower price per unit only when they take an action that signals higher commitment or lower willingness-to-pay (such as buying in bulk or off-peak).

By implementing these kinds of fences, you move from a one-size-fits-all price to a tailored pricing architecture that recaptures value far more effectively. Each customer ends up closer to a price that reflects their value from the product. The result: you significantly shrink the triangle of lost profit – converting more would-be consumer surplus into earned revenue, without alienating price-sensitive segments. Companies that master this kind of strategic price customization routinely see substantial margin expansion as they plug the leaks we identified earlier.

Step 3: Deploying an Accessible, Actionable Analytics Platform

Advanced pricing analytics are useless if they’re locked in a black box or accessible only to a few data scientists. The final step is to put this power directly into the hands of your commercial team with an accessible, actionable analytics platform. The deliverable here is not a static 100-page report – it’s a living, dynamic tool integrated into daily workflows. Think of a pricing “command center” dashboard that translates all the data science into intuitive guidance for decision-makers:

· A pricing manager can simulate the margin impact of a proposed discount or a new price policy before it goes live, seeing the projected waterfall and pocket margin effect.

· A sales rep preparing a deal quote can see a real-time “deal score” or guidance based on similar past deals – flagging if a proposed discount would put the deal below acceptable margin, and suggesting alternative structures (like a smaller discount or a value-added service) to close the sale profitably.

· Executives can monitor key pricing KPIs (like average realized price vs. list, discount percentages, pocket price variance) in near-real time via a dashboard, drilling down by region, product, or customer segment to spot problem areas.

More importantly, this platform must be user-friendly and built with the sales and pricing teams, not imposed on them. Fostering user adoption is critical: the best analytics in the world won’t matter if your team doesn’t use them. We find that co-building solutions with end-users (pricing analysts, sales managers, finance) creates buy-in and ensures the tools address on-the-ground needs. For example, if the sales team helps design the deal score interface, they are far more likely to trust and use it. Embedding the platform into existing systems (like integrating pricing guidance into your CRM or CPQ software) further drives adoption by making it part of the natural workflow.

By empowering people with real-time, causal insights and easy-to-use tools, you change pricing from a backwards-looking administrative task into a forward-looking strategic capability. Your team can act quickly on opportunities (and issues) that the data reveals – whether that’s adjusting a discount policy that’s eroding margin, or doubling down on a successful promotion structure. This step is where the cultural change happens: pricing stops being an opaque finance exercise and becomes an organizational competency, with Finance, Sales, and Marketing all working off the same data and insights. The pricing engine you’ve built doesn’t just reside in a model or a database – it lives in the daily decisions of your team.

The Revify Pricing & RGM as a Service Platform was designed by Revology partners—former Pricing and Commercial Executives—and relies on an automated data pipeline of integrated/harmonized transactional and other commercial data pieces (e.g., CRM data), coupled with AI/ML for pricing scenarios and product cross-sell recommendations.

Turning Recaptured Value into Measurable Growth

When this blueprint is executed, companies cease to be victims of their pricing complexity and instead become masters of it. The payoff is tangible financial gains and a more resilient business. Let’s look at two examples of strategic price customization in action – and how recaptured value translated into real growth:

• Deutsche Bahn’s BahnCard – Transforming Value Perception: Consider the case of Deutsche Bahn, the German national railroad. For years, travelers paid a simple per-kilometer fare on trains. This made driving seem more economical for many, since drivers only considered the marginal cost of fuel for a car trip. Deutsche Bahn introduced the “BahnCard,” a clever two-part tariff (a form of first-degree price discrimination) where customers pay an upfront fee for a card that then gives 50% off all subsequent train tickets for a year. This structurally changed the value equation. After buying the BahnCard, the per-trip cost of train travel drops dramatically (often below the cost of driving fuel for the same journey), so customers have a strong incentive to take the train more often to “make use” of their 50% discount. The result was a significant increase in ridership and higher overall profit. This wasn’t just a temporary price cut – it was a strategic re-engineering of the pricing model that unlocked immense value. By using a two-tiered pricing structure (upfront fee + discounted usage), Deutsche Bahn effectively captured more customer surplus and boosted both volume and revenue. The BahnCard program is now widely cited as a successful example of price discrimination increasing market share while maintaining profitability.

• Smarter Trade Promotions at a CPG Manufacturer: Now take a leading Consumer Packaged Goods manufacturer whose trade promotion spending was a classic black hole. They were granting hefty off-invoice discounts and marketing co-op funds to retailers, but year after year the manufacturer saw flat volumes and shrinking margins. By implementing a Promotion Effectiveness Analytics platform (part of the broader pricing engine we described), they finally gained visibility into which promotions drove true incremental volume and which did not. They ran data-driven experiments: for instance, cutting a long-running promotion that the data showed was merely shifting timing (customers were waiting for the promo to buy, but annual volume didn’t grow) and instead doubling down on a seasonal display campaign that showed high incremental lift in a pilot. Over the course of a year, the manufacturer reallocated budget to the high-ROI promotions and eliminated a slew of wasteful discounts. The result was an 8% increase in gross profit and a 15% improvement in trade spend ROI. In other words, they got more volume bang for each promotion buck, and much of the previously leaked margin flowed back to the bottom line. Equally important, the sales team started having more analytical conversations with their retail customers – using facts about promotion performance to negotiate for better terms – rather than simply offering the standard rebates. This strengthened their retailer relationships and made future promotions even more effective.

Sample Promotion Effectiveness & Optimization module for a Consumer Products company.

Beyond the numbers, companies that build this pricing capability discover powerful secondary benefits. A sophisticated, analytics-driven pricing function becomes a competitive moat in its own right. It allows the business to respond rapidly to market changes – whether that’s a new competitor price move, a spike in costs, or an opportunity to upsell a customer – with confidence and precision. In volatile times, this agility and insight can mean the difference between hitting profit targets or hemorrhaging margin. Furthermore, when Finance, Sales, and Marketing are all working from the same causal data and tools, much of the internal friction around pricing disappears. Instead of debates based on anecdotes or opinions (“Sales keeps underpricing!” “These targets are unrealistic!”), the conversation shifts to facts (“This segment has lower price sensitivity, we can push price here” or “Promotion X isn’t yielding ROI, let’s reinvest in Promotion Y”). Decision velocity increases and execution becomes far more consistent. The organization moves from reactive firefighting to proactive strategy.

Building a Lasting Capability, Not a Temporary Fix

For decades, business leaders facing complex pricing challenges have been presented with two unappealing options:

(1) License a rigid “black-box” pricing software and contort your business to fit its logic, or

(2) Hire a big consulting firm for an expensive project that leaves you with a thick report but no greater internal capability.

It’s time to embrace a third way: strategic empowerment of your own team. The goal should not be to simply install a tool or get one-time advice, but to build a permanent, in-house pricing capability that becomes a competitive asset.

This is a philosophical choice about the kind of organization you want to lead – one that is self-reliant, agile, and continuously learning – versus one that must always rely on external crutches. By investing in your people and processes (with the guidance of a partner where needed), you develop your greatest asset: a team that can make smarter, more profitable decisions every day, using data as their guide. Pricing, when done strategically, touches every part of the business from product development to sales negotiations, so developing this muscle internally yields dividends well beyond just higher margins – it creates a culture of fact-based decision making.

Choosing the right partner for this journey is crucial. It’s not about buying the fanciest software or paying for a one-off strategy deck – it’s about aligning on vision. The right partner acts as a catalyst: they provide the framework, advanced tools, and expert coaching to accelerate your team’s development, with the explicit goal of making themselves obsolete. In practice, this means the partner helps you implement the data foundation, customization frameworks, and analytics platform we discussed, but always in a collaborative mode with knowledge transfer. Over months and quarters, your team gains the skills and confidence to run the show. At the end of the engagement, the value – the improved margins, the analytical tools, and the know-how – stays with you.

Pricing complexity and market volatility are only going to continue to increase, and building this in-house pricing excellence is perhaps the greatest competitive advantage you can create. When you empower your organization to strategically manage pricing – plugging leaks, customizing value capture, and responding deftly to change – you transform pricing from an afterthought into a core engine of growth. The companies that do this aren’t just temporarily shoring up profits; they are fundamentally redefining their trajectory. If you are a leader who believes in building sustainable internal capabilities and is ready to recapture the value leaking from your pricing, we invite you to start that journey.

Contact Revology Analytics for a complimentary discovery session to explore how an advanced analytics-driven, in-house pricing capability can become your next great competitive advantage. Let’s talk about how strategic price customization – done with the right data foundation and tools – can stop your profit leakage and drive sustainable growth.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.