Revenue Growth Analytics Maturity in 2025: Why Pricing Punch Still Matters, and How to Land It

Introducing Revology Analytics’ Revenue Growth Analytics (RGA) Maturity Scorecard, the 2025 results, and what separates the few leaders from the pack.

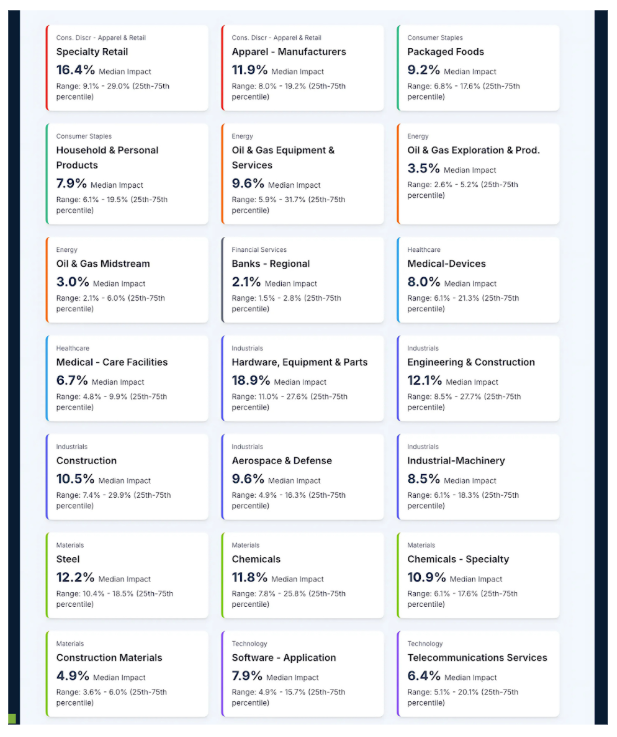

For decades, executives have cited a famous statistic: raise price 1%, and operating profit jumps 11.1% (HBR, 1992). In 2025, we revisited that claim with contemporary data across ~2,000 public companies. The punch is still there—pricing remains the most reliable profit lever—but its magnitude is now more uneven. The median impact across all industries is ~6.4%, with stark variation by sector and sub‑sector. Automotive shows a ~17.4% median lift from a 1% net price realization; Industrials ~9.4%; Consumer Staples ~9.2%. Utilities pace lower (~4.4%), Real Estate (~3.1%), and Financial Services (~2.2%). Even within technology, Software—Application centers near ~7.9% while Hardware, Equipment & Parts can approach ~18.9%.

Revology revisited the iconic HBR price impact study.

Sub-industry deep dive of a +1% Net Price Realization on Operating Profit $.

If pricing remains the most dependable lever, Revenue Growth Management (RGM)—how you set, execute, measure, and reinforce pricing, promotion, and customer‑level growth—determines whether you can capture that value consistently. That is precisely what Revology’s Revenue Growth Analytics (RGA) Maturity Scorecard measures.

This article introduces our Scorecard approach and unpacks the results of the 2025 RGA Maturity Report, with contrasts to our inaugural 2023 benchmark. The punchline: the market has made incremental progress, but the distance between ambition and execution remains wide—especially in promotion ROI and sales/marketing enablement. We close with practical, 90‑day playbooks to help leaders turn measurement into money.

The Scorecard at a Glance: Four Pillars That Power (or Drain) Profit

The RGA Maturity Scorecard assesses capability across four areas that together determine whether price potential becomes profit:

Pricing Analytics & Optimization (PA&O)

Promotion Effectiveness & Optimization

Sales & Marketing Enablement (sales & customer growth analytics)

Pricing & Profitability Strategy

Each area is scored into four tiers—Low (0–25%), Medium (26–50%), High (51–75%), and Very High (76–100%)—and we compute an overall maturity score as an aggregate across pillars. The instrument is a structured self‑assessment completed by commercial leaders covering strategy, process, tooling, cadence, adoption, governance, and outcomes. While self‑reported maturity can skew a bit optimistic for organizations early in their journey, the patterns and correlations (e.g., to leadership support and operating cadence) are robust and actionable.

Who responded in 2025?

N = 158 commercial leaders, with a diverse industry mix: Manufacturing (23.1%), Retail (19.2%), Consumer Goods (17.3%), Distribution (13.5%), Technology (9.6%), and Other (17.3%). The largest company‑size cohort is 10,001+ employees (25%), but smaller companies often score surprisingly high—agility and fewer silos matter. Geographically (IP‑based), participants span the U.S. (26%), India (13%), Canada (8%), the U.K. (6%), and others including Brazil, South Africa, Australia, Finland, and Germany.

2025: The State of Maturity (and the 2023 Contrast)

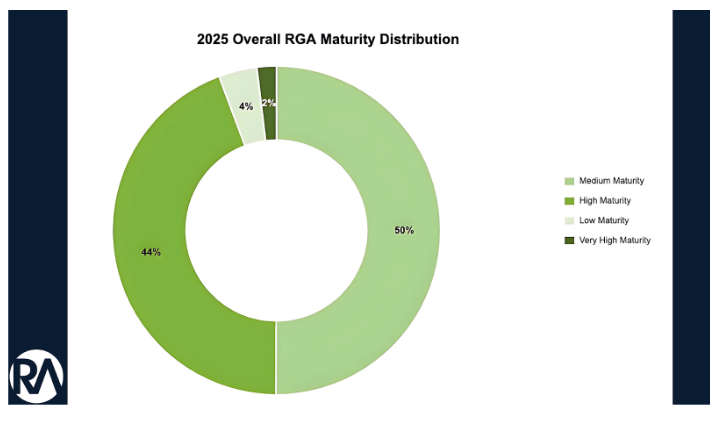

Overall maturity distribution (2025):

Low: 3.8%

Medium: 50.0%

High: 44.2%

Very High: 1.9%

Half of the organizations benchmarked remain at Medium RGA maturity, indicating significant headroom for improvement.

Put simply, half of organizations still sit in Medium overall maturity, with a healthy 44.2% in High but only a razor‑thin 1.9% in Very High. This is incremental progress versus 2023, but excellence remains elusive:

2023 vs. 2025: In 2023, roughly 50% of firms were in Low/Medium combined; in 2025, it’s ~53.8% (Low 3.8% + Medium 50.0%). The Very High tier shrank from ~7% in 2023 to under 2% in 2025. High held roughly steady (~43% in 2023 vs. ~44% in 2025).

The takeaway: Buying tools alone has not moved the needle. Foundational strategy, talent, process, and adoption remain the bottlenecks.

Industry dynamics: Technology and Consumer Goods again rank higher overall, while Manufacturing and Distribution lag—particularly in Sales & Marketing Enablement, where Manufacturing shows 66.7% of respondents at Low maturity in 2025. Larger enterprises generally report higher maturity, but size is not destiny; several mid‑market challengers have leapfrogged by being cloud‑native and agile.

AI reality check (2025): Interest is high, but usage is pragmatic: ~42% report AI primarily for automating manual tasks, while only ~6% apply it for advanced insights generation. Hype hasn’t translated into broad maturity jumps—another reminder that foundations precede frontier tech.

Why Maturity Matters: Price Potential Meets Operating Reality

Recall the profit leverage math: if your sub‑industry can realize a double‑digit profit lift from a modest price move, the question is not only “Should we price?” but “Can we realize it?” That depends on your RGM maturity:

Weak maturity: Manual discounting leaks value; promo budgets oxidize without ROI discipline; growth becomes expensive when CLV, churn prediction, and CRM hygiene are missing.

Strong maturity: Clear governance and incentives; price realization and PCVM (Price‑Cost‑Volume‑Mix) monitored at useful cadences; self‑serve analytics and fit‑for‑purpose tooling accelerate insight‑to‑action.

In short: pricing still packs a punch, and RGM maturity determines whether you land it where it counts.

Deep Dives by Pillar

1) Pricing Analytics & Optimization (PA&O)

2025 distribution: 57.7% High, 5.8% Very High, 32.7% Medium, 3.8% Low—the strongest profile of the four pillars. Yet execution gaps are real:

How prices are set: ~75%+ still rely on cost‑plus and/or competitor benchmarks; ~24% use value‑based approaches in some form; only ~8% show advanced value‑based pricing at scale.

Cadence: 36.1% revise regularly but manually; 29.2% revise annually or less; ~15% do dynamic pricing.

Discounting execution: 61.4% manage deal pricing manually; 15.7% use automated workflows.

Price waterfall: 50.7% have no price waterfall.

Competitive intel: 71% operate with ad‑hoc or scattered competitive price data.

Pricing Analytics & Optimization shows the highest relative maturity among the four RGA areas, with over 63% of firms at High or Very High maturity.

Why it matters: Without robust instrumentation (e.g., price waterfalls, elasticity modeling, net price realization scorecards), organizations cannot react nimbly to market changes or defend margins consistently. The gap between strategic intent and deal‑level reality is where profit leaks.

What lifts maturity:

Executive sponsorship for PA&O lifts average maturity by ~16–17 points.

Self‑serve BI correlates with higher PA&O maturity than “no tool” or sporadic spreadsheets.

Cadence counts: more frequent measurement of net price realization and semi‑annual/quarterly elasticity updates track with higher maturity.

120‑day roadmap (PA&O):

Days 0–30: Define requirements; finalize the data model for a price waterfall and price realization tools; consolidate transactions, discounts/rebates, costs, and competitor signals. Run manual analysis on the top discount/leakage drivers and institute immediate deal guardrails.

Days 31–90: Build the BI assets; validate inputs; stand up a competitive price capture process; draft the Pricing Council charter.

Days 91–120: Launch the Price Waterfall and Weekly Price Realization scorecard; train sales/pricing teams; pilot rule‑based dynamic pricing in one channel; plan top‑SKU elasticity refresh.

What “Very High” looks like: Dynamic pricing supported by ML‑enabled elasticity simulators; segmented, value‑based strategies; deal guidance embedded in quoting/CRM; price quality or pocket margin shows up in comp; weekly/monthly realization reviews; continuous learning loops.

2) Promotion Effectiveness & Optimization

2025 distribution: 57.7% Medium, 30.8% High, 3.8% Very High, 7.7% Low—a stubborn middle. Execution gaps are acute:

Planning: 86.8% set promo calendars manually; only 13.2% use optimization tools.

ROI quantification: ~63% cannot quantify incremental ROI (e.g., gross profit per $ of price investment).

Leadership: Executive recognition is tepid relative to pricing.

Why it matters: Without a clear view of baseline vs. lift and incremental profit, trade dollars become a blunt instrument. Spend tilts toward habit rather than evidence; margins quietly erode.

What lifts maturity:

Executive endorsement for promo analytics lifts average maturity by ~24 points (top vs. bottom).

In‑sourced BI often beats turnkey tools on adoption and cost in mid‑market contexts—especially early on—so long as data hygiene is addressed.

Regular elasticity updates (for price/promo interactions) further strengthen impact as the capability matures.

90‑day roadmap (Promo E&O):

Days 0–30: Define requirements for a Promo ROI tool; consolidate promo, spend, POS/syndicated, and financial data; manually build a promo ledger for the last quarter; publish top/bottom‑10 ROI by tactic/channel.

Days 31–60: Build the BI tool; stand up a promotions task force; use manual findings to reallocate 10–20% of spend toward higher‑ROI tactics.

Days 61–90: Launch Incremental ROI analytics; train teams; institute quarterly optimization gates; plan uplift/elasticity models and promotion‑mix optimization.

What “Very High” looks like: Full ROI transparency for each promotion; a portfolio approach to promo investments; scenario planning routine; sales uses insights in line reviews; CFO/CMO co‑own effectiveness dashboards; near‑real‑time visibility with anomaly flags.

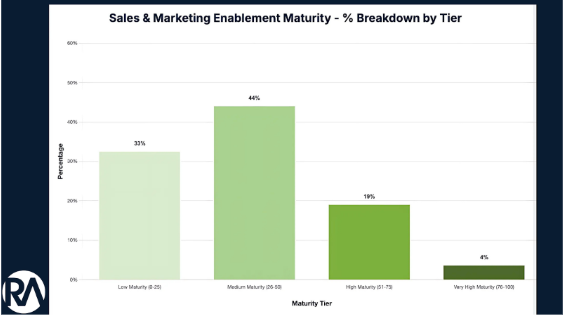

3) Sales & Marketing Enablement (Sales & Customer Growth Analytics)

2025 distribution: 32.7% Low, 44.2% Medium, 19.2% High, 3.8% Very High—the widest opportunity gap.

Foundational gaps:

Churn prediction: 58.5% do not predict churn.

CLV: 64.2% do not measure Customer Lifetime Value for resource allocation.

Segmentation (RFM): 64.2% do not use basic RFM.

CRM data: 34% rate data quality Poor; 28.3% report no CRM.

Marketing ROI: ~70% lack channel/campaign ROI visibility.

Sales & Marketing Enablement remains the least mature area, with 77% of organizations scoring below High maturity.

Why it matters: Without reliable customer‑level analytics, sales teams fly blind on retention and cross‑sell; marketing budgets drift toward activity over impact; CLV lags, churn rises, and CAC bloats.

What lifts maturity:

A strong, research‑backed value proposition vs. competitors correlates with ~21‑point higher maturity.

Leadership understanding of PCVM correlates with higher overall maturity—organizations allocate effort more rationally when they truly grasp price, cost, volume, and mix.

90‑day roadmap (S&M Enablement):

Days 0–30: Clean the top 10 CRM fields (ID, industry, size, contact, region, last order date, product family, revenue, gross margin, channel); stand up basic RFM cohorts and at‑risk flags in CRM/BI.

Days 31–60: Define requirements for Churn Prediction and CLV tools; publish a weekly manual churn‑risk list to sales; draft qualitative CLV tiers; track campaign‑level ROI for two priority channels.

Days 61–90: Launch an initial Churn Prediction model; integrate next‑best‑action playbooks into CRM; roll out a save‑offer playbook for at‑risk cohorts; reallocate 10–15% of budget to highest‑ROI channels.

What “Very High” looks like: A 360° customer view; CLV and propensity modeling drive prioritization; automated alerts and playbooks for churn risks; MMM for macro allocation and MTA for in‑channel optimization; frontline tools embedded in CRM with manager‑level coaching analytics.

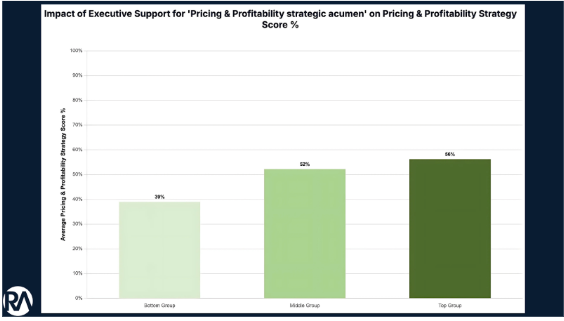

4) Pricing & Profitability Strategy

2025 distribution: 53.8% High, 7.7% Very High, 32.7% Medium, 5.8% Low—on paper, a relatively strong showing. But there’s a strategy‑execution gap:

Executive recognition: ~65% of leaders agree strategic pricing acumen matters; the remaining ~35% can still block resources.

KPIs & integration: 56.4% set segment‑specific pricing goals, but only 23.1% tie them to compensation and corporate goals.

Alignment: ~29% report misalignment between sales and product/pricing incentives.

Profitability monitoring: Only ~23% integrate cost‑to‑serve and scenario analysis; 24.2% have no systematic monitoring.

Methods: Only ~8% employ truly value‑based pricing over cost‑plus conventions.

Why it matters: Strategy without governance (KPIs → comp), instrumentation (PCVM), and incentive alignment is aspiration. “Rogue” discounting and manual exceptions will overpower a slide deck every time.

What lifts maturity:

Executive support boosts Strategy maturity by ~17 points on average.

Smaller firms sometimes score higher overall, demonstrating that agility > headcount without strong governance.

Executive support significantly boosts Pricing & Profitability Strategy maturity, creating a 17-point differential between top and bottom groups.

90‑day roadmap (Strategy):

Days 0–30: Codify pricing principles and five core KPIs (price realization, discount spend %, waterfall leakage, promo ROI, pocket margin); draft a plan to tie 1–2 KPIs into comp and QBRs; define requirements for PCVM reporting.

Days 31–60: Build PCVM reporting in BI; publish role charters (who owns list price, exceptions, promo funding); launch the Pricing Council (Sales, Product, Finance, Marketing); finalize comp alignment changes.

Days 61–90: Launch PCVM reporting (quarterly moving to monthly); run pre‑mortems for major price moves and post‑event ROI reviews for promotions; connect Strategy to PA&O and Promo E&O tools for a tight strategy‑execution loop.

What “Very High” looks like: Strategic pricing is C‑suite owned (e.g., a Chief Pricing Officer); value‑based methods and willingness‑to‑pay research are routine; PCVM is institutionalized; realized price mirrors intent because approval workflows and comp discourage leakage; experimentation (e.g., subscription or performance‑based pricing) is ongoing.

Cross‑Cutting Insights from the 2025 Scorecard

Leadership conviction is a multiplier.

Top‑quartile executive support correlates with +17 to +24‑point gains across Strategy, PA&O, and Promo maturity. Mandates move mountains.Cadence converts theory into cash.

Firms that monitor net price realization weekly/monthly and refresh elasticities semi‑annually/quarterly score highest in PA&O—and act while the window is open.Tooling that teams use beats “best‑in‑class” shelfware.

Self‑serve BI consistently correlates with higher maturity. For many mid‑market teams, in‑sourcing the first wave of analytics drives faster adoption and lower cost.Foundations first; sophistication follows.

Without price waterfalls, PCVM, CLV, churn, and promo ROI, advanced ML and “AI‑first” promises underperform. Start where the P&L bleeds.Size ≠ maturity.

Smaller firms can out‑execute via tight loops and less organizational drag; larger firms can win—but only with stronger governance, alignment, and change management.

Sector Context: Calibrating Ambition to Economic Reality

To translate a 1% price improvement into profit credibly, calibrate ambition to your industry’s leverage:

High‑leverage sectors (e.g., Automotive; Hardware/Equipment): Justify a faster cadence, tighter guardrails, and heavier investment in deal guidance.

Moderate‑leverage sectors (e.g., Industrials; Consumer Staples): Win with segmented value communication and waterfall discipline.

Lower‑leverage sectors (e.g., Financial Services; Utilities): Focus on leakage control, mix management, and PCVM—often more powerful than pure price.

A Pragmatic Path: What You Can Change in the Next 90 Days

Across all four pillars, the critical moves are consistent:

Secure a mandate. Name accountable owners for PA&O, Promotions, S&M Enablement, and Strategy.

Fix foundations. Define requirements and build the data model for Price Waterfall and PCVM; create a Promo ROI ledger; clean CRM fields; stand up RFM cohorts.

In‑source, then scale. Build first‑wave capabilities in your BI stack; automate the workflows that control leakage (deal guardrails, exception management).

Align incentives. Tie 1–2 KPIs (e.g., price realization, pocket margin) to compensation and QBRs.

Raise the cadence. Where economics warrant, shift price realization reviews from monthly to weekly; refresh elasticities on a semi‑annual/quarterly cycle; run quarterly promo optimization gates.

If you implement just those steps, the Scorecard data says your maturity—and your profit realization—moves meaningfully in one quarter.

What Has (and Hasn’t) Changed Since 2023

Progress, but not transformation. The proportion of High‑maturity firms is steady; the Very High cohort shrank. This is not a failure of tools; it’s a reminder that adoption, governance, and cadence are the limiting reagents.

PA&O remains the bright spot, but the leap to Very High is rare; value‑based methods and dynamic pricing remain under‑deployed.

Promotion analytics stalled in the middle. The majority still cannot quantify incremental ROI—leaving significant value on the table.

Sales & Marketing Enablement is still the frontier. Churn prediction, CLV, and basic RFM segmentation are absent for too many teams; CRM data quality continues to drag.

Strategy is often well‑stated, less often well‑enforced. KPIs exist, but few are wired into comp plans or operating rhythms; PCVM and cost‑to‑serve visibility are not yet standard.

The throughline: leaders who treat RGM as an operating system—not a project—pull away from the pack.

From Insight to Advantage: Your Operating Model

To make maturity stick, leadership teams that outperform adopt common scaffolding:

C‑Suite sponsor (CFO or CRO) who owns the RGM P&L thesis.

Pricing Council with Sales, Product, Finance, and Marketing meeting biweekly to review waterfalls, competitive moves, exceptions, and promo reallocations.

Analytics pod—small, cross‑functional, close to the business—that builds and maintains the BI assets and ensures decisions are served (not just dashboards shipped).

Cadences that match economics: Weekly (price realization exceptions, at‑risk accounts), Monthly (PCVM, promo reallocation), Quarterly (strategy pivots, elasticity refresh scope).

Avoid the anti‑patterns we see most often: AI‑first without foundations, tooling without adoption, siloed incentives, and annual price cycles in dynamic markets.

Conclusion: The Punch Is Real—Now Land It

Our 2025 Scorecard confirms what many leaders feel: the market hasn’t shifted dramatically since 2023. The punch of pricing is there, but execution gaps—manual discounting, weak waterfall discipline, limited promo ROI, and underpowered sales enablement—still siphon value. Where senior leaders visibly back RGM, wire KPIs into compensation, and insist on operating cadence, maturity jumps by double digits. Tooling your teams will use (often inside your existing BI stack) and governance that clarifies 1ownership convert analytics into profit.

Start where the P&L bleeds. In the next 90 days, secure the mandate, build the data backbone, and launch the foundational tools—Price Waterfall, Weekly Price Realization, Promo ROI, RFM/CLV, and Churn. Tie 1–2 metrics to comp. Raise the cadence. The objective isn’t “more analytics.” It’s more profitable growth with less friction.

Want the Full Benchmarks, Industry Breakouts, and Playbooks?

The article above scratches the surface. The full whitepaper includes sector‑by‑sector leverage charts, sub‑industry benchmarks, cross‑tabs linking leadership support and cadence to outcomes, and step‑by‑step implementation guides you can hand to your teams.

→ Download the 2025 Revenue Growth Analytics Maturity Report & Scorecard to see where you stand, what to fix first, and how leaders convert price potential into profit.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.