Tariffs, “Sneakflation,” and the Pricing Tightrope

Tariffs Are Quietly Draining Consumer Wallets and Business Margins

A trio of recent news items paints a stark picture: import tariffs are increasingly squeezing Americans’ wallets and business margins. Economists even have a term for it – “sneakflation” – as the extra costs sneak into prices on store shelves. Harvard researchers found that U.S. imported goods now cost ~5% more (and even domestic goods ~3% more) than they would have without recent tariffs. Goldman Sachs estimates that by this fall, up to 67% of tariff costs will be borne by American consumers, up from just 22% earlier this year. In other words, Americans are footing the bill for these tariffs in the form of higher prices.

The Revify platform evaluates your Month-over-Month and Year-over-Year Price Realization and Cost Inflation trends before allowing you to dive deeper into the casuals.

Even retail giants like Walmart can’t shield shoppers indefinitely. CEO Doug McMillon noted the chain’s costs are “rising each week” due to tariffs, and while Walmart will try to delay price hikes, these costs will inevitably trickle down. Retailers often resort to gradual price increases – the so-called sneakflation – to pass tariffs in small increments that consumers might not immediately notice. But make no mistake: over time those increments add up. Economists warn that as more tariffs kick in and even domestic suppliers hike prices, consumers could ultimately bear nearly 100% of these added costs.

And it’s not just big retailers feeling the pinch. Small businesses are scrambling as a key duty exemption ends. Starting August 29, the U.S. eliminated its decades-old de minimis rule that allowed imports under $800 to come in duty-free. That exemption covered a staggering 1.36 billion packages in 2024 alone. With its removal, a $5 trinket ordered from overseas may now cost nearly double once tariffs and processing fees are applied. Foreign postal services have even paused shipments to the U.S. rather than navigate the new rules, leaving countless small e-commerce sellers in the lurch[10]. One trade council expert warns many small online sellers could be driven out of business, as these entrepreneurs lack the scale to absorb or efficiently pass on the new import duties. Larger firms might manage, but for “micro” importers, this is an existential hit.

Then there’s the latest tariff whiplash: in mid-August, President Trump slapped a 50% tariff on steel and aluminum, dramatically expanding its reach. Suddenly 407 categories of products that use steel or aluminum – from butter knives and baby strollers to deodorant cans and fire extinguishers – got 50% more expensive to import overnight. Importers were caught off guard with goods already in transit now stuck in a lose-lose scenario: pay a ruinous tariff upon arrival, or abandon the shipment entirely. The intent was to close “loopholes” and prevent tariff circumvention], but the practical effect is a huge cost shock across supply chains. Analysts predict these steep levies will ripple through manufacturing, raising costs in construction, automotive, electronics and more. And while businesses might try to avoid passing every penny of tariff cost to customers, absorbing a 50% cost increase is unrealistic – much of it will have to be priced in[15]. In short, these tariffs function like a massive, sudden tax on inputs that manufacturers and distributors will push downstream where they can.

The takeaway: Tariffs – whether gradual or abrupt – are driving up costs at every link in the chain. American consumers are already paying more for everyday goods because of it, and small businesses and mid-market manufacturers are seeing margins evaporate as their costs climb. This aligns with what we’ve been warning for a while: tariffs are effectively a consumption tax on Americans, and no one in the value chain is immune. If Walmart, with all its scale, is raising prices due to tariffs, you can bet every smaller player upstream is feeling the squeeze too.

So, if you’re a manufacturer or brand, how do you respond? Simply accepting margin erosion or slapping uniform price increases on everything is a recipe for competitive and financial pain. The challenge is clear: you must pass on cost increases smartly and surgically, not bluntly – protecting your profitability where possible without killing your volume or customer goodwill. Achieving that balance requires a far more strategic approach to pricing and promotions than many companies currently have in place.

The Wrong and Right Ways to Manage Tariff-Driven Costs

When facing tariff-induced cost jumps, many companies’ gut reaction is to raise prices across the board – for example, implement a blanket price hike equal to the tariff percentage to “keep margins whole.” It feels straightforward and fair. It’s also often flawed. Decades of pricing science and real-world experience show that treating all products and customers the same in a cost crisis will likely backfire[22][23]. Why? Because price sensitivity isn’t uniform – not across customers, not across SKUs, not across categories.

If you ignore differences in elasticity, you invite predictable problems[24]:

Volume Hemorrhage: Highly elastic items (where customers are price-sensitive or have alternatives) will lose volume rapidly if you jack up prices too much. A tariff may raise your costs 10%, but a 10% price hike on a very price-sensitive product could cut its sales by 20%+, negating the intended revenue gain. We’ve seen scenarios where a flat 20% increase on an elastic product led to a -22% collapse in volume – a net negative to both revenue and profit.

Margin Left on the Table: Conversely, some items are much less elastic. If you only raise those prices modestly (or not at all) because you applied the same across-the-board rate, you’re leaving money on the table. These products could likely bear a larger increase with minimal volume loss, helping recoup tariff costs – but a one-size-fits-all policy fails to capitalize on that. In one case study, a product line with very low elasticity was able to take a whopping +35% price increase with only ~1.6% drop in volume, dramatically boosting gross profit – but a uniform smaller increase would have underpriced it.

Channel/Customer Pushback and Chaos: If you indiscriminately raise prices, especially on items where customers have substitutes, expect blowback. Retail buyers or B2B customers will push back hard on increases they view as unjustified, or they’ll shift purchases to competitors. Your sales team, caught in the middle, may start carving out ad-hoc exceptions and discounts to save deals. Suddenly your “uniform” policy turns into a patchwork of special cases, eroding margins and sowing internal confusion.

Profit Dilution Despite Higher % Margins: The ultimate irony is that a blanket cost-plus markup can still lead to lower total profit dollars even if your percentage margin stays okay on paper. If you lose enough volume on high-contribution products, the margin percent on what’s left sold might look fine, but your total gross profit could drop. In analysis we’ve done, a “moderate” uniform increase actually boosted revenue but reduced total gross profit because it didn’t cover cost increases on key items. The mix shifted in a bad way.

Clearly, pricing blindly or by averages is not the answer. So, what should companies be doing? Based on our work with clients and industry best practices, here’s the strategic playbook for navigating tariffs and similar cost shocks:

Re-evaluate Every Promotion’s ROI Under the New Costs: Many promotions that used to make sense may now be outright margin killers after your COGS jump. That BOGO or deep discount deal that was barely breaking even before? It’s almost certainly a money-loser now with higher unit costs. CPGs must rigorously analyze true promotion profitability (including what it does for the retailer’s margin, not just your volume) under current costs. If a promo isn’t clearly driving incremental volume and profit, cut it or redesign it. Tariffs essentially shrink the “budget” for inefficient promos – you can’t afford to give away margin on deals that aren’t pulling their weight. Yet studies show fewer than 15% of trade promotions deliver positive ROI even in normal times, and most companies struggle to pinpoint which promotions leak margin. Now is the time to find and fix those leaks. In fact, one major manufacturer we worked with launched an initiative to rationalize promotional events specifically to offset tariff cost pressures, eliminating low-performing deals to shore up gross margin[37].

Run “What-If” Scenarios Before Any Price Increase: Don’t even think about handing a new price list to customers without first simulating the outcomes. You need to model: If I raise prices on Product Line A by 10%, what happens to volume and profit? What if key customers push back? What if our competitor holds their price on that item? This scenario planning is non-negotiable in today’s environment.

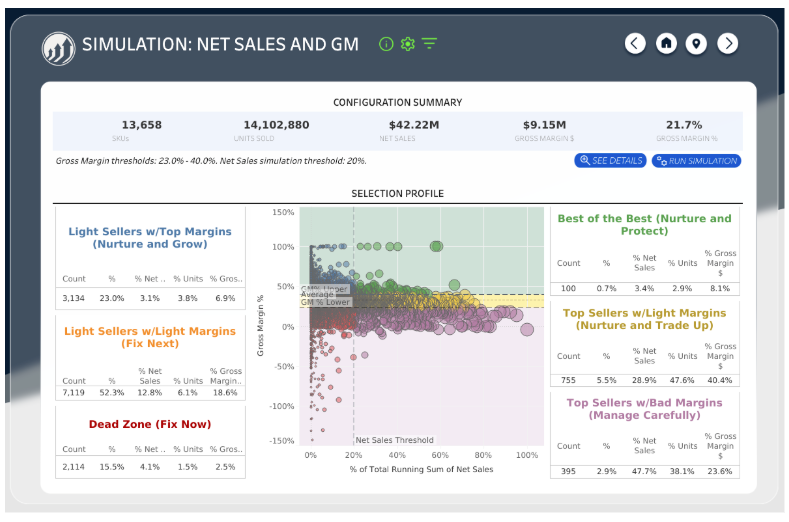

Revify’s Net Sales vs. GM% simulator allows the user to surgically adjust customer and/or product prices or Margins requirements to understand the Volume, Revenue or Profit impacts of their actions.

3. Every pricing move should be vetted through robust elasticity models and forecasting tools. For example, before a consumer goods client of ours took a price increase to a major retailer, we ran multiple scenarios varying the increase by SKU and incorporating possible retailer reactions. This exercise identified a few SKUs where even a 5% hike would likely drop volume so much it erased margin – so those were held flat while others went up 8-10%. The result? A far more balanced outcome that protected profitability without surprising the customer. If you lack an internal tool for this, invest in one or seek a partner – flying blind is too risky when each move could make or break your quarter’s numbers.

4. Get Granular with SKU-Level Price Elasticity: Averages will mislead you; you need to know exactly which products are price sensitive and which aren’t. If you haven’t done a price elasticity analysis recently (or ever), now is the time. This means leveraging your historical data (and maybe some machine learning) to estimate how each SKU’s demand responds to price changes. You might discover, for instance, that your premium flagship product has a –0.3 elasticity (very inelastic – customers will tolerate price hikes) while a secondary commodity-like SKU is –2.5 (highly elastic – volume tanks with any increase). Armed with that, you can segment your pricing strategy: push harder on the inelastic items (they can carry more of the tariff burden) and tread carefully on the elastic ones, perhaps using targeted promotions or smaller increases to maintain volume. In the fastener distributor case study we analyzed, this “surgical” segmented approach (ranging from +8.75% up to +35% on different product families) delivered the best outcome – it maximized gross profit dollars and grew revenue, whereas blanket increases either hurt volume too much or didn’t recover costs. The data was unequivocal that an elasticity-driven strategy beat the blunt alternatives.

5. Monitor and Leverage Competitor Movements: Tariffs often impact entire industries, not just one company. If your competitors are raising prices due to tariffs (and many will be), don’t ignore the shift – use it to your advantage. We saw after the 2018 steel tariffs that even companies not directly hit often followed with price hikes because overall market prices reset upward. Keep a close eye on your competitors’ pricing. If they are taking increases, you may have headroom to raise yours a bit more without losing share – capture that margin! Conversely, if they are absorbing costs to undercut the market, you need to know that too and possibly hold your fire. The key is maintaining your competitive price position strategically. One recommended approach is tracking a Competitive Price Index (CPI) – essentially your price vs. market benchmark – and deciding how much CPI gap you can afford for each product/customer segment. If tariffs push everyone’s prices up, you might keep the same index (stay in line), or even opportunistically improve your margin by letting your price rise towards the high end of an acceptable index range. But these decisions must be data-driven. We often build clients a competitive pricing dashboard that shows where their price is out of line (too high or too low) versus competitors, so they can correct course. In tariff times, such a tool is invaluable for finding pricing “whitespace” – i.e. spots where you could raise price because the market moved and you haven’t (or where you need a tactical decrease to avoid losing volume to a slower-moving rival).

6. Understand the Full Value Chain & Profit Pool Impact: When you raise prices, it’s not happening in a vacuum. Particularly for B2B manufacturers and CPGs selling to retailers or distributors, you must consider how your increase affects their economics. If you give Walmart a 10% list price increase, how much of that can they pass to shoppers? Will it squeeze their margin on your product? And if so, will they reduce promotional support for your brand or give more shelf space to a competitor with less pressure? Savvy pricing teams map out the profit distribution along the chain. This means knowing your own margin, your channel partner’s margin, and even the end-customer impact. By doing this “profit pool” analysis, you can approach price changes in a collaborative way – maybe you adjust trade spend or offer a phased increase to help the retailer manage, in exchange for something else. The goal is to avoid a zero-sum game. For instance, one CPG client found that a list price increase would decimate a key retailer’s category margin if promotions remained the same, so they proactively restructured some trade promotions to compensate. The result: the retailer accepted the price hike because their overall dollar profit stayed whole, and the CPG still improved its net position. This level of insight and partnership is only possible if you’ve done your homework on the economics end-to-end.

7. Arm Your Sales Teams with Data and Narratives: Your sales or account managers are the ones who have to deliver the news of price increases to customers (retail buyers, distributors, etc.). If all you give them is a new price list and a pat on the back, you’re setting them up – and by extension your pricing initiative – to fail. Instead, equip them with clear, insight-backed stories to justify the changes. This includes: evidence of your cost increases (e.g. “our input costs on these 5 materials are up 20% due to tariffs, here’s the data”), analysis of value delivered (e.g. “our product still delivers $X more in consumer value or saves you $Y vs. the competition”), and scenarios showing the shared outcome (e.g. “even after this increase, your margins on our line will be in line with last year’s after accounting for the tariff – we’ve made sure of that”). If the buyer pushes back with “we can’t take that price,” your team should be ready with options or concessions backed by numbers (perhaps less promotional funding on some low-ROI deals in exchange for the higher everyday price – which might actually help the buyer’s margin). The point is, data-driven transparency can turn a confrontational negotiation into a problem-solving session. We’ve seen this firsthand: a sales team armed with an interactive price/margin model and competitive analysis was able to walk a retailer through why a price increase was necessary and how they could both still make money – and they closed the deal with far less friction than usual. Give your teams the tools and analysis, and they can turn a tough conversation into an opportunity to deepen trust.

Taken together, these steps represent a much more nuanced approach than “cost up, price up.” They require effort – better data, better analytics, cross-functional coordination – but this is the new reality of pricing in an uncertain trade environment. As we noted when Walmart’s tariff-induced price hikes first hit the news, the winners will be those who lean into sophisticated, integrated pricing and promo strategies, executed with surgical precision. Tariffs aren’t going away in the short term. In fact, history shows they tend to stick around longer than expected. So building these strategic pricing muscles isn’t just for this quarter’s crisis – it’s an investment in resilience for years to come.

From Analytics to Action: Tools to Mitigate Tariffs (Our Take)

All of the above sounds great in theory – but it’s easier said than done. Many companies, especially mid-market manufacturers or those without huge pricing teams, might be reading this and thinking, “Sure, elasticity modeling and profit pool analysis sound ideal, but we don’t have the bandwidth or systems for that.” This is a very real concern. In fact, over half of mid-market companies admit they have low-to-medium analytics maturity in pricing, and only ~10% use predictive analytics for pricing decisions consistently. Data is often siloed in ERP systems, spreadsheets, and maybe a syndicated data portal – making it extremely hard to get a single source of truth on what’s driving margin or volume. Mid-size firms can be “data rich but insights poor,” lacking the tools that Fortune 500 companies deploy for pricing simulations.

That capability gap is exactly what we’ve been working to close. There are two parallel solutions we’ve developed – one aimed at CPG and large enterprise contexts, and one tailored for mid-market industrials and distributors – but both share the goal of bringing advanced pricing analytics to those who need it, quickly and in a focused way.

An arsenal of advanced Pricing & RGM Analytics at your fingertips with Revify.

What is that? It’s essentially a custom analytics platform – often built on familiar tools like Power BI or Tableau – that unifies all your relevant data (internal and external) in one place and serves up the specific pricing and revenue management insights you need. Rather than relying on a patchwork of ERP reports, Nielsen/IRI portals, and ad hoc Excel sheets, you get a single source of truth that connects price, cost, volume, mix, promotions, and even channel partner data. This integration is crucial. For example, one electronics CPG we worked with had to combine internal ERP sales data with retailer POS scans, syndicated category trends, and even scraped online competitor prices – and then layer in advanced price elasticity models. No off-the-shelf tool could do all that, so an integrated Navigator was built to harmonize these sources and surface real drivers of performance. The pain of disjointed data went away; in its place was a clear view of how price and promotions were affecting gross profit in real time, by SKU and by customer.

A proper Pricing/RGM Navigator typically includes modules or dashboards to tackle each of the pain points we discussed. Think margin waterfalls and price waterfalls that show exactly where margin is leaking – by customer, by SKU, by deal type – as costs and pricing change. Think net sales and gross profit “bridges” that break down how much of last month’s drop in GP was due to lower volume versus higher costs versus mix shifts. These kinds of insights let you zero in on the root causes of margin erosion (e.g., a specific promo or a specific input cost spike) so you can address them. The Navigator also brings in promotional effectiveness analysis – measuring true incremental volume and ROI of each promo, so you can cut the losers fast. And importantly, it has a scenario planning tool: a sandbox where you can model price changes or promo tweaks and see the projected impact on volume, revenue, and profit instantly[61][62]. Remember all that “non-negotiable” what-if analysis we said you must do? A well-built analytics Navigator makes it as easy as a few clicks to run those scenarios, powered by predictive models instead of gut feel.

Crucially, this isn’t a black-box third-party software that dictates answers. It’s your internal platform, configured to your business’s realities. That means full customization and ownership – you define the metrics, the hierarchy, the business rules. You’re not stuck waiting on a vendor’s generic dashboard update. We emphasize this because many “turnkey” solutions force you into their view of the world, whereas an integrated Navigator is built for your nuances (whether that’s how you calculate adjusted gross profit or how you segment customers). The result is higher adoption and trust: your teams actually use it daily because it speaks their language and they helped design it. And by using common tech stacks (like Azure/SQL for data warehousing and Power BI/Tableau for viz), you often end up with lower total cost and faster deployment than big one-size-fits-all software. We’ve seen companies get an initial version live in a matter of weeks, not a year, by taking an agile development approach with the Navigator concept.

What does this look like in action? In one recent project, we delivered a Pricing & RGM Navigator for a fast-growing CPG brand (in the food & beverage space). Their CEO, CFO, and sales leaders now open a Power BI app each morning that shows exactly how net sales and gross profit are tracking, with the ability to drill into why (price vs. volume vs. mix vs. cost) for any major change. It also flags which SKUs are below target price indices in the market (indicating a potential price increase opportunity) and which promotions last month had subpar ROI and should be reviewed. Perhaps most powerfully, the team can simulate a tariff-driven cost increase in the model: they input a hypothetical +X% COGS on products A, B, C, and the Navigator outputs a recommended pricing action plan – how much to raise each SKU (based on elasticity and competitive position) and which promotions to adjust – along with the forecasted impact on volume and profit. Essentially, it’s a “navigation system” for pricing decisions under turbulence. The outcome: despite a recent raw material cost spike, they’ve been able to hold their gross margin % flat (when many peers saw margins dive) by surgically implementing price changes guided by the Navigator’s insights. That’s the power of marrying data with strategy.

For Mid-Market Manufacturers/Distributors: Many of the mid-sized industrial firms we talk to want those same capabilities, but fear they can’t afford the time or cost to build it themselves. In those cases, we offer an accelerated solution via our Revify Analytics platform – essentially Revenue Growth Management as a Service (RGMaaS). Revify is designed to deliver enterprise-grade pricing analytics without the usual heavy lifting, tuned to mid-market needs. It combines a ready-to-deploy analytics platform with on-demand expert advisory, usually stood up within a couple of weeks.

What’s under the hood? The Revify platform comes with pre-built modules for all the critical analyses: it ingests your data and quickly generates price elasticity models at the SKU and customer level, so you can see where you have pricing power and where you’re vulnerable. It includes an intuitive scenario analysis sandbox – you can test, say, a “full pass-through” vs. “partial pass-through” vs. “segmented” pricing strategy and instantly see the projected revenue, volume, and gross profit outcomes for each. It tracks net price realization (i.e. after discounts/rebates) so you ensure that any tariff surcharges or list price hikes aren’t being negated by back-door margin leakages. And it offers a suite of supporting dashboards – from high-level KPI scorecards to detailed P&L bridges (price/volume/mix/cost) to customer-specific profitability and even cross-sell recommendations – giving a holistic view of your revenue health[.

The “as a Service” part is equally important. We learned that dumping a fancy tool on a mid-sized company without support often fails; people are busy, and change is hard. So Revify includes embedded expert advisors who work alongside your team. These are pricing and RGM pros (actual humans) who help interpret the analytics, validate model outputs, and translate them into real-world actions. They’ll even help prepare the selling points for your sales reps or the presentation to the exec team about the proposed pricing moves. It’s like having an on-demand pricing strategy team in addition to the software. This combination ensures that insight actually turns into execution – which is where the ROI is realized.

To illustrate the impact, consider the case highlighted earlier of the mid-market fastener distributor facing a sudden tariff on their products. Using Revify’s toolkit, they loaded two years of data, got elasticity insights for each product line, and evaluated multiple pricing scenarios within days. The platform revealed that a blanket increase would either tank volume or fail to recoup margin fully, whereas a segmented approach (big increase on one line, moderate on another, slight decrease on the third to stay just under a competitor’s price) would both protect volume and maximize profit[. The analytics predicted – and later real results confirmed – that this strategy (Scenario C) would yield the highest revenue and highest gross profit of all options considered. In raw numbers, they ended up about +$2.6M higher in annual gross profit vs. doing nothing, and even ~$800K higher than a blanket 20% hike would have yielded And they did this without alienating customers, as evidenced by only a ~1-2% volume dip overall. Essentially, Revify’s elasticity-driven playbook turned a tariff crisis into a manageable, even opportunistic, outcome. That kind of result is transformative for a mid-size firm – it’s the difference between a nasty earnings surprise and a confident, data-backed plan that the leadership can get behind.

The bigger picture: whether via a custom-built Navigator or a service like Revify, the goal is to move from reactive “fire-fighting” to proactive, insight-driven pricing. Tariffs, inflation, commodity swings – these pressures will continue. By investing in analytics and capabilities now, you’re not only solving today’s problem but also building lasting resilience. Companies that master this will enjoy faster decision cycles (we’ve seen pricing analysis that used to take weeks reduced to hours), more fact-based internal alignment (pricing debates become about numbers, not hunches), and stronger positioning when negotiating with customers (confidence rooted in knowing your value and constraints). In contrast, those that stick to spreadsheet-gut-instinct pricing will find themselves perpetually a step behind – either absorbing too much cost or incurring avoidable volume losses, and fighting internal battles while the market shifts around them.

At Revology Analytics and Revify, our philosophy is that technology and analytics should augment your pricing strategy, not replace it. There’s no “easy button” – but there are smarter tools and approaches. Tariffs have effectively raised the stakes and separated the leaders from the laggards. The leaders are using this moment to implement analytic pricing engines under the hood of their business. The laggards… well, they might still be hoping tariffs will disappear or that old-school cost-plus will somehow suffice. As the evidence shows, hope is not a strategy.

The bottom line: Tariffs may be out of your control, but your response is within your control. You can’t avoid paying more for inputs, but you can avoid panic and paralysis. With the right data-driven strategy – and the right tools to execute it – you can intelligently pass through costs, cut inefficiencies, and even find opportunities to strengthen your market position amidst the chaos. American consumers are learning the hard way that tariffs ultimately hit their pocketbooks. It’s up to businesses to ensure those cost pressures are managed in a way that protects their own viability and reputation. By taking the steps outlined above, and leveraging modern Pricing/RGM analytics solutions (like our CPG Pricing & RGM Navigator for an integrated approach or the Revify RGMaaS platform for rapid mid-market deployment), companies can turn these tariff headwinds into merely another navigable challenge – one that, with skill, can be met without capsizing the ship.

In the end, pricing is about far more than math; it’s about strategy, execution, and yes, sometimes politics. Tariffs test all three. Those that invest in being proactive, data-savvy, and agile will not only survive this “sneakflation” era, but come out stronger – with a pricing organization that can handle whatever the next storm brings. As we often remind our clients: don’t waste a good crisis. Use it to build pricing capabilities that last. Your bottom line will thank you, and so will your customers in the long run. Now is the time to tighten your pricing strategy – to walk the tariff tightrope with confidence – knowing you have the analytics safety net in place below.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.