Why Your CPG Needs an Integrated Pricing & RGM Navigator (And Why It Beats Turnkey Solutions)

Mid-market Consumer Packaged Goods (CPG) companies are facing a critical challenge: their data is fragmented across internal systems (ERP, Trade Management Systems, Inventory Data) and external sources (syndicated data, retailer portals, feature/advertising data), making it nearly impossible to get actionable, timely and most importantly integrated insights for Pricing and Revenue Growth Management (RGM). Most available analytics tools (especially turnkey platforms tied only to the syndicated data provider ecosystem) leave teams stuck with incomplete, lagging, or generic insights that don’t reflect the real drivers (and opportunities) of profit or loss in their business.

Where the Real Pain Lies

The real pain for CPGs isn’t just data overload—it’s the inability to connect the dots between price, promotions, volume, mix, cost, and channel partner margins in a way that drives profitable decisions. In our work and conversations with leadership at Food & Beverage companies (and some Consumer Electronics businesses), we see this pain manifest in several critical ways:

Pervasive Margin Erosion & Missed ROI: Promotions are run without clear measurement of incrementality, often subsidizing baseline sales and eroding gross margins. With studies showing that less than 15% of trade promotions deliver a positive ROI, most CPGs can’t pinpoint where margin is leaking or how to fix it.

An integrated view helps measure each promotion's true incremental profit contribution and ROI, along with highlighting the gaps between planned performance and actual results.

Siloed, Reactive Decisions: Teams operate in silos, relying on manual spreadsheets or basic syndicated data dashboards that don’t integrate internal transactional data. This leads to “analytical fire drills” and reactive price-matching, rather than strategic, insights-driven moves.

Vendor Lock-In & Black Box Analytics: Turnkey syndicated data solutions often lock clients into rigid environments, making it hard to customize, integrate new data sources, or even understand the logic behind “black box” recommendations (if there’s a predictive analytics component). As we heard in discussions with a $1B Beverage company, this means slow adaptation to market changes and little organizational learning.

Loss of Data Ownership: With black box vendor solutions, companies often don’t own their analytics logic, elasticity models, or even their harmonized data. This critical point blocks internal capability-building and makes future migration or integration costly and risky.

These frustrations are not abstract. For example, a Consumer Electronics CPG needs to create a unified environment that could harmonize internal ERP data with POS, syndicated reports, and scraped competitor data with advanced price elasticity and cross-elasticity models—a bespoke requirement far beyond the scope of generic tools. In each of our client use cases, the core focus is on building capability internally, not outsourcing insight.

The Solution: An Integrated, Owned RGM Analytics Navigator

The answer is to invest in an integrated Pricing & RGM Analytics Platform that unifies internal and external data, embeds advanced analytics and is built for your business—not the industry average. This approach delivers actionable, real-time insights, empowers your teams, and breaks the cycle of vendor dependency. We call this a Pricing & RGM Analytics Navigator, and it is built on four foundational pillars.

1. Unified Data Integration: The Single Source of Truth

The first step is to connect internal and external data streams—ERP, TPM, POS, syndicated data, and distributor sell-out feeds—into a single, harmonized data warehouse. By using modern ETL/ELT pipelines to automate these data flows, you eliminate silos and ensure every analysis is grounded in your company’s reality, not just market averages.

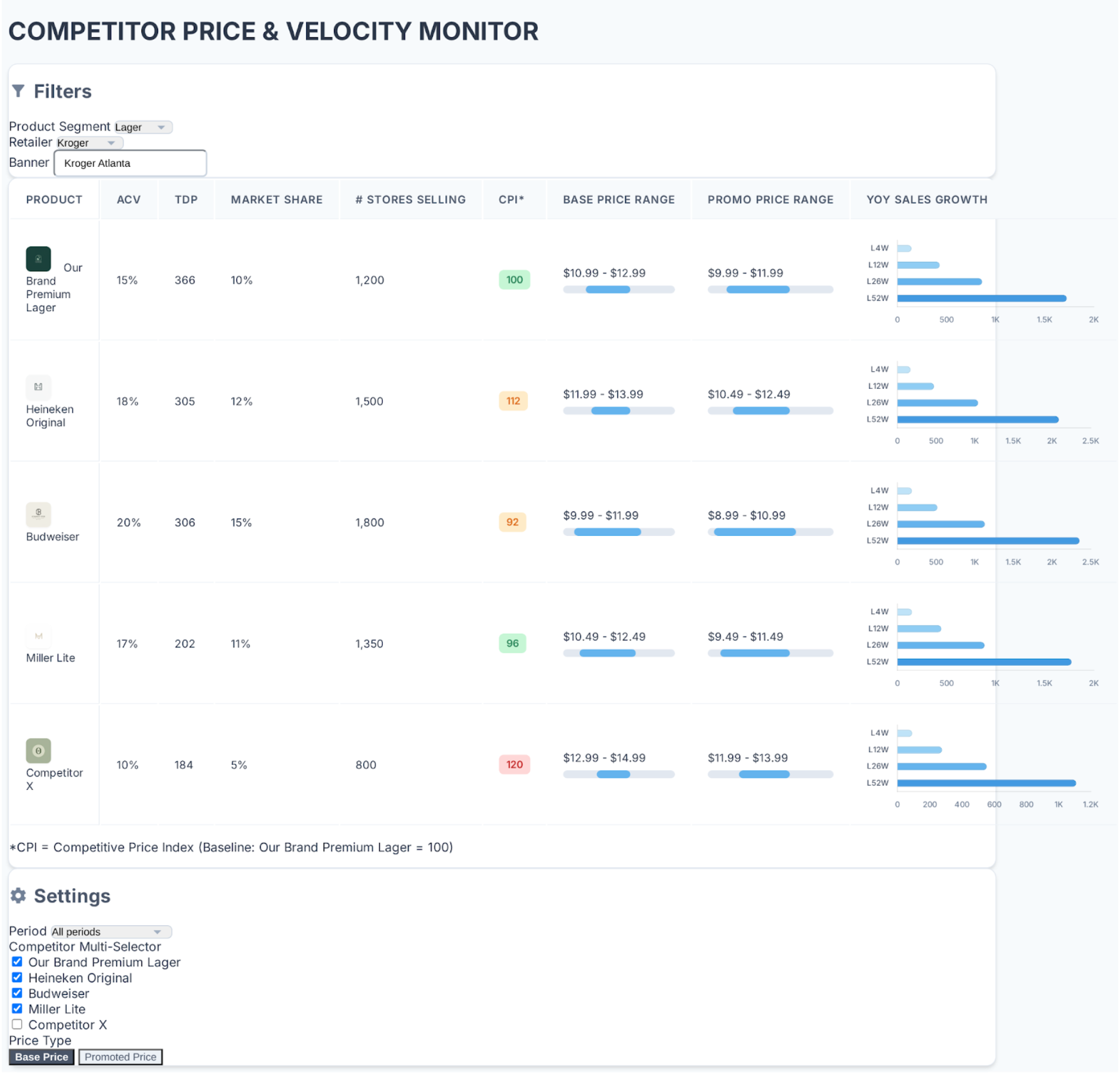

This sample view provides updated comparative analyses on base and promo pricing vs. key competitors and highlights product groups and retailers whose price position is outside of guidelines.

2. Advanced Analytics & Scenario Modeling

With a unified data foundation, you can move beyond descriptive reporting to true prescriptive analytics. This includes:

Margin Waterfall & Profit Pool Analysis: Visualize net price realization from one period to the next (or vs. budget), pinpointing every source of margin leakage by SKU, customer, and channel. This provides the forensic view needed to understand where promotions are truly eroding or building value.

A Net Sales or GP$ bridge instantly diagnoses the financial impact of price, cost, volume, and mix, and provides a dynamic deep dive of key profit dilutive or accretive areas, down to the customer-SKU level.

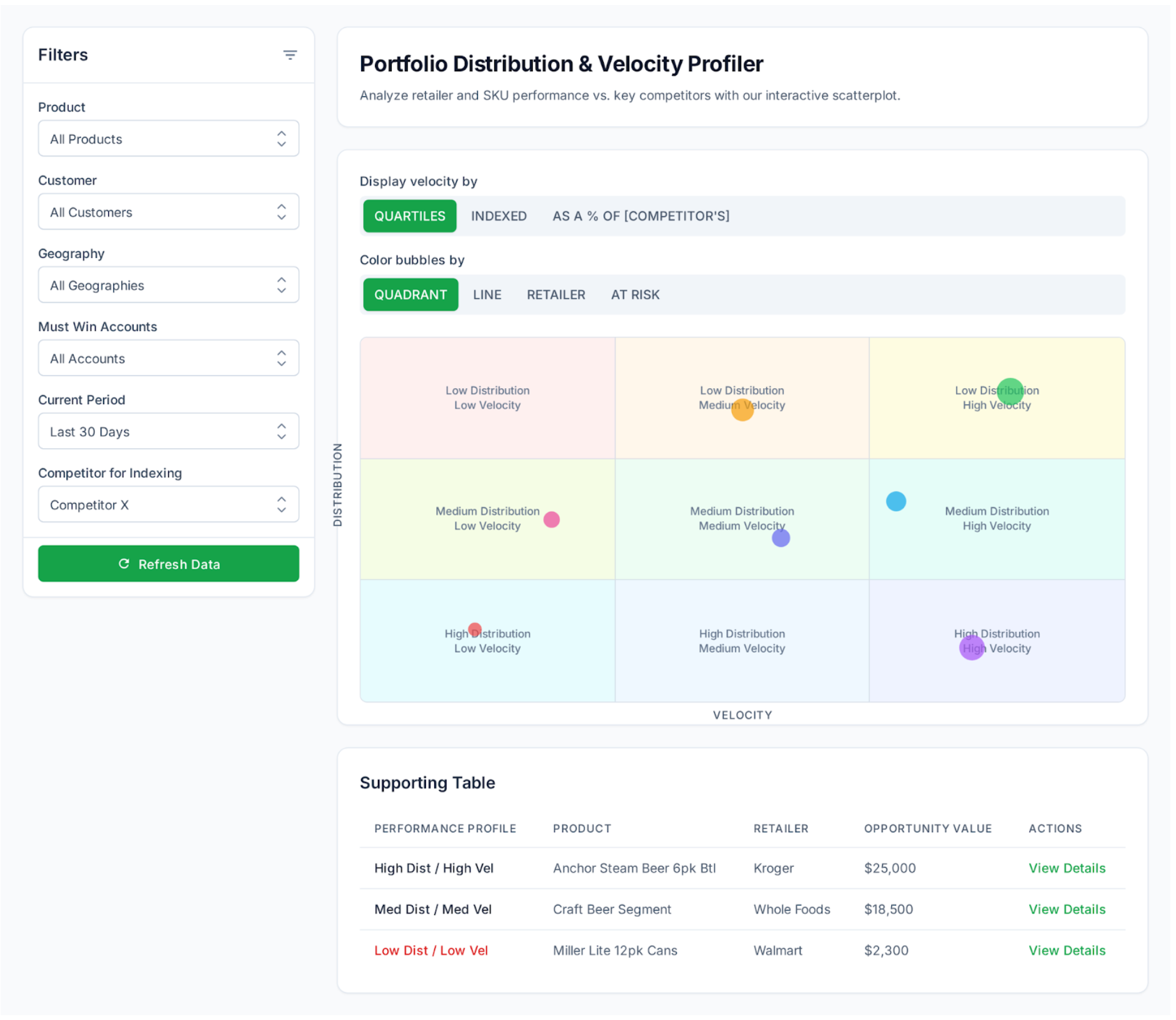

The Distribution & Velocity Profiler automatically segments your portfolio, providing a clear strategic roadmap for every SKU at every retailer to maximize growth and profitability.

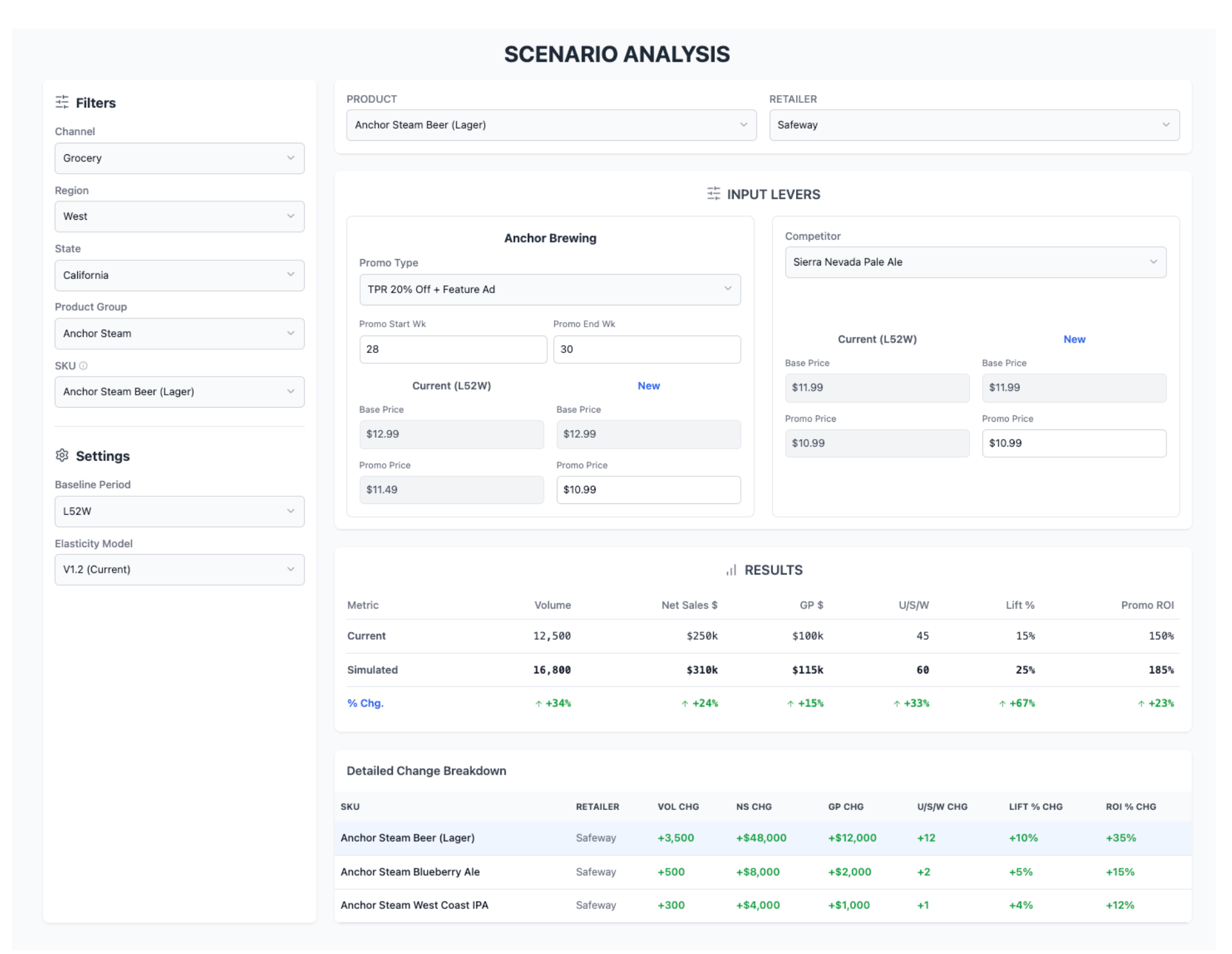

Predictive Elasticity & What-If Scenarios: Move beyond static assumptions by building machine learning models to capture true price sensitivity and competitive cross-elasticities. This powers a “What-If” simulation tool, empowering teams to model the P&L impact of price changes, new promotions, or competitor moves before making costly decisions.

A scenario analysis tool section allows Pricing & RGM teams to simulate the volume, net sales, and ROI impact of different pricing and promotion strategies before they are deployed.

3. Customization, Ownership, and Flexibility

This is the most critical differentiator. An integrated platform allows you to:

Build Tailored Analytics: Create modules and dashboards that reflect your unique product hierarchy and go-to-market strategy, not generic templates.

Eliminate Vendor Lock-In: You own your data models, code, and logic. Your teams can adapt, expand, or migrate the platform as business needs evolve, without being held hostage by SaaS contracts.

Empower Internal Capability: When cross-functional teams co-design and own the solution, it drives higher trust, skill-building, and adoption across the organization.

4. Lower Total Cost of Ownership & Faster Time-to-Value

By building on familiar tech stacks like Tableau or Power BI, you avoid the heavy, recurring fees of enterprise SaaS vendors. Agile, modular development ensures the platform evolves with your business, delivering value in months, not years, and avoiding the slow, expensive customization cycles common with turnkey solutions.

The Ideal Outcome: From Reactive to Commanding

The ideal solution is a unified, in-sourced Pricing & RGM Analytics Platform that delivers:

Automatically Updated, Actionable Insights: No more lagging, partial, or siloed views—see the true drivers of revenue and margin, instantly.

Predictive & Prescriptive Analytics: Proactively optimize pricing, promotions, and mix using advanced, scenario-based tools.

Organizational Ownership & Agility: Your teams own the logic, models, and data, enabling continuous improvement and adaptation.

Lower TCO & Higher ROI: Avoid heavy SaaS fees and build a platform that scales with your business and delivers a measurable impact.

Final Advice

If you’re a CPG leader frustrated by siloed data, generic dashboards, and slow, expensive vendor solutions, it’s time to rethink your approach. Don’t settle for black box analytics or “good enough” syndicated data dashboards. The brands that win in today’s market are those that build internal muscle for advanced, integrated analytics—enabling them to out-think and outmaneuver the competition. The path to sustainable, profitable growth is through an integrated RGM platform that unifies your data, empowers your teams, and puts you in control of your future.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.