What is Your True Net Price? The Ultimate Guide to B2B Commercial Psychology & Profit Realization

What is Your True Price?

For decades, a benchmark study from the Harvard Business Review shaped pricing strategies worldwide, holding that a 1% price gain led to an 11.1% improvement in operating profit. It was a powerful statistic that underscored the immense leverage of pricing. But is it still true today?

Our recent analysis at Revology Analytics revisited this benchmark, examining financial data from over 2,000 publicly traded companies. The findings are clear: while pricing remains an incredibly potent profit lever, the landscape has changed. The median impact of a 1% price improvement on operating profit across all industries is now 6.4%. This leverage varies dramatically, from a staggering 17.4% in the Automotive sector to just 2.2% in Financial Services. Even within a single sector like Technology, the impact ranges from an 18.9% median for Hardware to 7.9% for Application Software.

These numbers tell a critical story: while the power of pricing is undeniable, averages are dangerously misleading. Your true potential for profit is dictated by the unique economics of your industry, your market, and your commercial discipline.

Yet, Revology’s 2025 Revenue Growth Analytics Maturity Report reveals an alarming gap between this potential and current practice. The data paints a stark picture of an epidemic of negligence:

A staggering 50.7% of organizations admit they do not even use a price waterfall, the most foundational tool for visualizing profit leakage.

Over 75% cling to outdated cost-plus or basic competitive pricing, focusing on the list price instead of the realized price.

61% still rely on manual, inconsistent processes to manage deal discounting and price negotiations, inviting margin loss with every transaction.

The hard truth, confirmed by our 2025 research, is that competitors are not stifling profitability; it is being systematically dismantled from the inside. This happens when leaders chase the vanity of top-line growth while a thousand unmanaged decisions hemorrhage margin. Reclaiming that lost profit requires a fundamental shift: abandoning the list price illusion and waging a disciplined war on price leakage. The only way to win is to build a commercial engine centered on the one number that tells the truth: your True Net Price.

The Anatomy of Margin Erosion

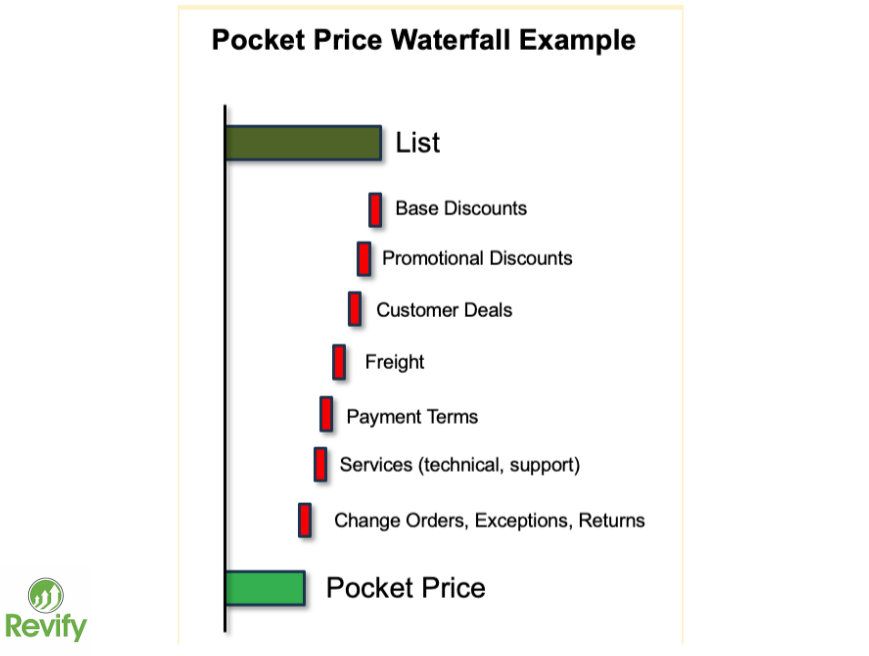

A simplified example of a Pocket Price Waterfall chart that visually breaks down how an initial list price is eroded by various discounts and price concessions. The final "Pocket Price" at the bottom represents a company's true net revenue from a sale.

The "True Net Price," or what pricing experts call the pocket price, is what remains after every discount, rebate, and allowance has been stripped away from the list price. The chasm between the two—the price waterfall—is where profit goes to die. This chronic underperformance isn't a single event but a death by a thousand cuts, driven by three distinct, systemic flaws.

The "List Price" Illusion

Companies invest enormous effort in setting the "right" list price. But this price is merely a starting point—a vanity metric. The real commercial activity happens after the price list is published. Sales offers off-invoice discounts to close deals. Marketing launches promotional programs with complex rebate structures. Finance doles out allowances for early payment or freight. Each decision is made in isolation, and the cumulative impact on the final pocket price is almost never calculated, let alone managed. The list price provides a false sense of security while the true price quietly erodes in the background.Fear-Based, Siloed Commercial Psychology

In most organizations, finance, sales, and marketing operate with conflicting incentives and no single source of truth. Sales is compensated on volume, leading them to use discounts as a blunt instrument to hit quotas. Marketing is judged on market penetration, often running promotions whose true ROI is a mystery. Finance is left to reconcile the aftermath, seeing only the resulting margin compression without context. This creates a culture of friction—fear of losing a deal, fear of missing a target—that encourages value-destroying decisions and prevents a unified, profit-centric approach.The Inevitable "Spreadsheet Swamp"

The default tool for tracking this complexity is the spreadsheet. But managing a modern price waterfall in Excel is a data-rich, insights-poor endeavor. Spreadsheets are manual, prone to error, and completely disconnected. They cannot provide a real-time, dynamic view of net price realization by customer, product, or region. They are rearview mirrors in a business that demands a forward-looking GPS, trapping companies in a reactive cycle of analyzing stale data long after the money has been left on the table.

The True Cost of Price Leakage

The damage from this failure to manage the price waterfall permeates every level of the organization, wreaking havoc on both internal culture and commercial effectiveness.

First, it creates a debilitating internal cultural cost. The natural tension between sales and finance escalates into damaging friction. Sales teams feel hamstrung by finance's focus on margin, viewing them as a barrier to closing business. Finance, in turn, sees sales as undisciplined cowboys. This lack of a single source of truth erodes trust, paralyzes strategic decision-making, and triggers chaotic, "fire sale" discounting at the end of every quarter—a practice that permanently undermines long-term value.

Second, from the customer's perspective, this reactive approach creates an experience of chaos and inconsistency. When pricing is unpredictable, it devalues the brand. It trains customers to negotiate for deals rather than partner for value. This behavior is incredibly difficult to reverse and results in significant unrealized profit, as the business fails to capture the true value its customers are often willing to pay.

The Solution: A Framework for Proactive Profit Realization

To escape this downward spiral, a fundamental shift is required. The strategic solution is a methodology we call Proactive Profit Realization, built on three core principles that directly counter the flaws of the status quo.

Embrace the Entire Price Waterfall: The first principle is to make the invisible visible. This means moving beyond the list price and obsessively measuring every single element—every discount, rebate, and chargeback—that creates a delta between the list price and the pocket price. This is the foundational step to understanding your True Net Price.

Establish Unified Commercial Intelligence: To break down departmental silos, you must create a single source of truth. When sales, marketing, and finance all view the same real-time dashboards showing how their decisions impact net price, the conversation shifts from blame to collaboration. It aligns incentives around the one metric that matters: realized profit.

Democratize Advanced Analytics: It’s time to drain the spreadsheet swamp. Proactive Profit Realization requires moving from static reports to a dynamic, accessible analytics platform. This democratizes the ability to not only see what happened but to model what could happen, turning data from a historical record into a predictive, strategic asset.

How a Modern Analytics Engine Powers Your Strategy

This methodology is not just theoretical; it requires a purpose-built engine to drive it. A modern revenue growth platform is designed to enable Proactive Profit Realization by translating its core principles into powerful, accessible capabilities.

Principle 1 (Embrace the Waterfall) is enabled by a Net Price Realization Module. This tool is designed to decompose the entire journey from list to pocket price. It provides an unequivocal, real-time view of your True Net Price, showing exactly where profit is leaking—by customer, SKU, and sales territory—so you can finally stop the bleeding.

This Sales Rep Price Discount and Opportunity Analysis dashboard identifies which salespeople offer the most discounts, comparing them against acceptable guidelines. The chart also quantifies the potential "Incremental GMS Opportunity," showing how much profit can be recovered by optimizing discounting behavior.

Principle 2 (Unified Intelligence) is enabled by KPI Dashboards and a Profit & Revenue Drivers Module. A powerful diagnostic like a Net Sales & Gross Margin Walk serves as the single source of truth, breaking down profit changes into the core drivers of Price, Cost, Volume, and Mix. It ends the debate over whose numbers are right and aligns the entire company around the shared goal of profitable growth.

Principle 3 (Democratize Analytics) is enabled by Price Fine-Tuning and Scenario Analysis Modules. Let's be frank: getting clean data and running predictive models is often the biggest hurdle. A modern platform removes this barrier. It automates the analytics, allowing you to pinpoint excessive discounting and simulate the bottom-line impact of pricing changes before you make them. It replaces the spreadsheet swamp with a predictive engine accessible to business users, not just data scientists.

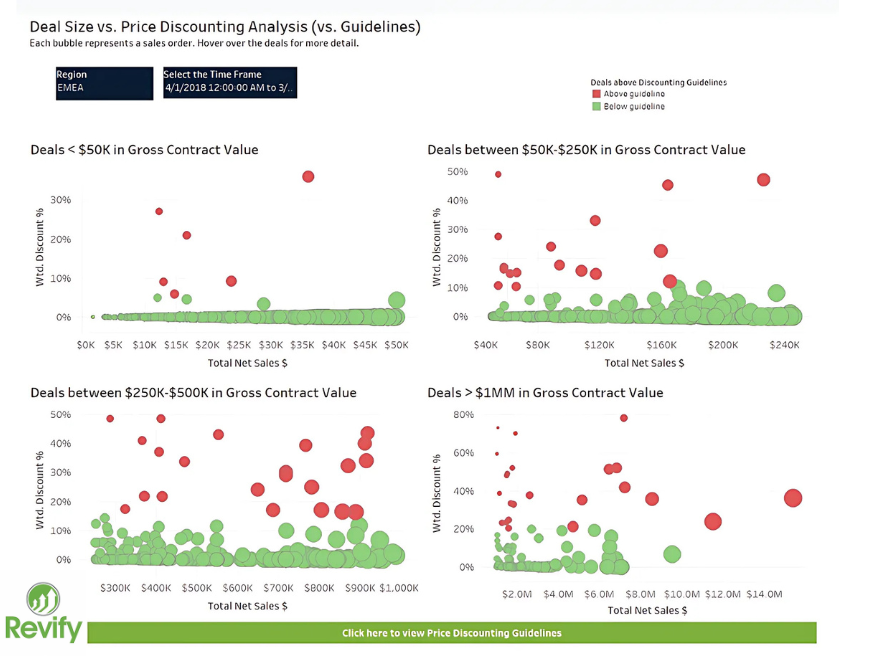

This Deal Size vs. Price Discounting analysis visualizes individual transactions, flagging deals with discounts that are above guidelines (red) versus those that are compliant (green). By segmenting deals into different contract value tiers, the analysis pinpoints where pricing discipline is breaking down.

This comparison table illustrates the difference between a reactive, "status quo" approach and a proactive, data-driven one for key commercial decisions. It demonstrates how using analytics for pricing and promotions protects margins and drives more profitable growth, in contrast to traditional methods that often erode them.

This Net Sales vs. Gross Margin analysis plots each customer to visualize their profitability and revenue contribution, segmenting them into quadrants like "Best of the Best" and "Top Sellers - Bad Margins." Such a diagnostic helps businesses understand where to focus their sales and pricing efforts for maximum impact.

Beyond the Quick Win: The ROI of Net Price Discipline

Adopting a Proactive Profit Realization framework does more than just boost short-term profits. It fundamentally transforms your commercial culture and builds a lasting competitive advantage.

Salespeople evolve from discount-driven order-takers into strategic partners who can confidently articulate value. Finance transcends its role as a historical scorekeeper to become a forward-looking strategic advisor. Marketing can finally measure the true ROI of its programs. This commercial engine, fueled by data and aligned on profit, becomes a powerful flywheel—a cycle of continuous improvement that competitors relying on spreadsheets and gut feelings simply cannot match.

Addressing the Real-World Hurdles to Implementation

Migrating to a new methodology can seem daunting. Let's address the common objections head-on.

"This sounds too complex. Our IT team is already overloaded."

This is a valid concern born from legacy enterprise software. Modern platforms, however, are cloud-based and require minimal IT overhead. The focus should be on rapid time-to-value, with initial insights delivered in weeks, not years."We can't afford expensive enterprise pricing software."

Traditional pricing platforms were prohibitively expensive. The new breed of analytics solutions is designed to fill this gap, often with transparent, subscription-based pricing. The ROI is swift, as the platform quickly uncovers unrealized profit that far exceeds the investment. Our research shows hidden profit leaks commonly range from 100 to 300 basis points of EBITDA—a massive opportunity for most mid-market firms."Our sales team will never go for this. They need flexibility."

This is the most critical hurdle. The goal of Proactive Profit Realization is not to eliminate discounts but to make them smarter. A modern platform empowers salespeople by giving them the data to understand which discounts create value and which destroy it. It helps them defend price and ultimately ties their success—and commissions—to the more durable metric of realized profit.

When a Tool Isn't Enough: Architecting Real Change

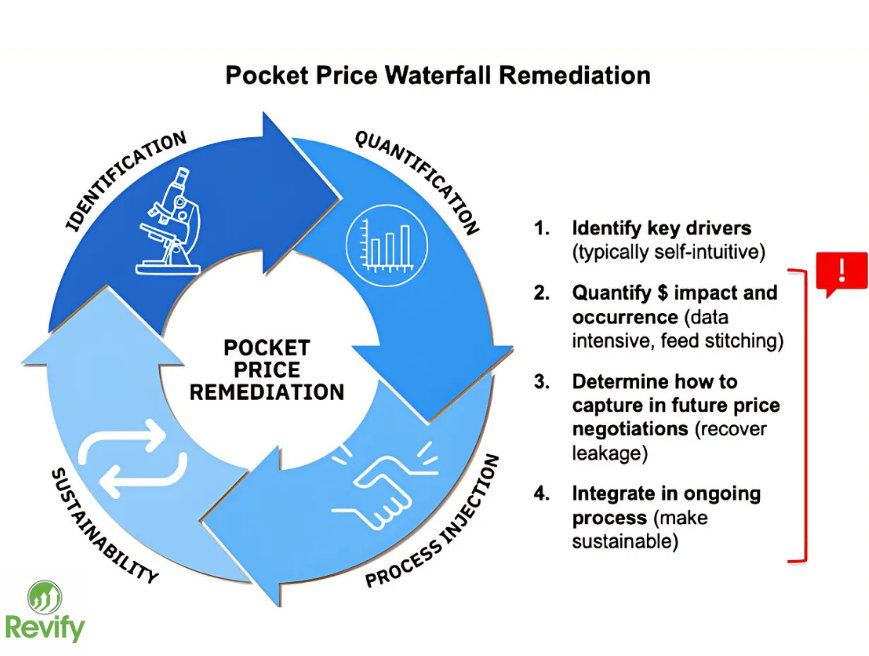

Our diagram illustrates the four-stage Pocket Price Waterfall Remediation process, a strategic framework for fixing profit leakage. The continuous cycle involves identifying key drivers, quantifying their impact, injecting process changes, and ensuring long-term sustainability.

For too long, businesses have fought the wrong war, focusing on top-line prices while the real battle for profitability is lost in the unmanaged details of the price waterfall. The relentless, silent erosion of profit can only be stopped by shifting your focus to the single most critical metric: your True Net Price.

By dismantling the status quo of siloed psychology and spreadsheet-driven chaos, you can finally unlock the profit you've been leaving on the table. While the right analytics provide the necessary visibility, lasting change is built on strategy and expertise. For leadership teams looking to architect a comprehensive profit realization program and navigate the complexities of organizational change, expert guidance is essential to turn these insights into a permanent competitive advantage.

Stop guessing what your price should be. It's time to know what it truly is.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.