The $1 Trillion Blind Spot: Why Most B2B Promotions Destroy Profit

For most B2B companies, particularly in manufacturing and distribution, promotional spending represents a massive and complex line item on the P&L. Yet for all its scale, it often produces the most ambiguous results. The core problem is a familiar and frustrating one: stagnant top-line growth and shrinking margins, even as trade spend climbs year after year. Leadership often points to external pressures (aggressive competitors, demanding channel partners, or volatile input costs) as the unavoidable cost of doing business in a tough market. This is especially the reality for most CPGs.

While these forces are certainly real, they often mask a deeper internal issue: a fundamental inability to measure promotional activities' true, incremental ROI. This analytical gap creates a powerful “Promotional Illusion,” where frantic activity is mistaken for profitable progress, and a huge portion of the budget is silently converted into margin destruction. The solution requires a shift in methodology, moving from reactive, defensive spending to a disciplined framework of Promotional Analytics and Optimization.

The ROI Black Hole

Promotional spending has long been treated as a standard lever to pull to drive volume, a tactical necessity rather than a strategic investment. But the lack of financial scrutiny is alarming for a Gross Profit outlay that routinely consumes 15-30% of gross revenues in sectors like CPG and can easily top 10% in industrial distribution.

According to the 2025 Revenue Growth Analytics Maturity Report by Revology Analytics, this is the statistical reality for most organizations. The study, which surveyed commercial leaders of mid-market companies, revealed a critical blind spot: 63% of companies admit they do not have a capability in place to quantify the ROI of their promotional investments.

This represents a fundamental failure to connect a major P&L expense to actual, incremental profit. Our central thesis is this: the majority of trade promotion spending is an unmanaged profit drain, not because of market forces, but because of a critical lack of ROI visibility. This analytical vacuum allows inefficient, margin-destroying activities like poorly structured rebates or blanket discounts (i.e. anchoring to what the competition does) to continue unchecked under the guise of “driving sales” or “the cost of doing business”.

The “Promo Illusion”

The “Top-Line Lift” Trap

The most common and misleading measure of a promotion’s success is the temporary spike in gross sales. A company runs a discount, sees revenue for that SKU jump 30% for the month, and the sales team declares victory. This is a dangerous fallacy because it celebrates a vanity metric while ignoring the two questions that matter: 1) How much of that lift was truly incremental? and 2) What percentage of our baseline sales did we just subsidize?

The reality is that a significant portion of that "lift" comes from customers who would have purchased the product anyway, but now do so at a lower price. In effect, you’re not earning new business; you’re subsidizing existing demand, directly converting full-margin sales into discounted ones.

The most effective way to avoid this trap is to perform a simple but powerful sanity check before the promotion ever launches: calculating the Break-Even Price Elasticity. This quick analysis answers a critical question: "What would our product's price elasticity have to be to remain gross profit neutral?"

Take a common year-end scenario: a proposed -40% price cut on a key product.

To break even on revenue, the product's price elasticity might only need to be -1.7. For many businesses, this seems achievable, creating a false sense of security.

But the truly critical question is about profit. To break even on gross profit dollars, the required elasticity might be an astounding -10.

Stated differently, to make the same gross profit dollars you would have without the promotion, your unit volume would have to surge by 400%. Faced with that staggering number, the "reasonableness" of the promotion evaporates. Without this quick, upfront analysis, a company can easily mistake a top-line mirage for a profitable oasis, all while the promotion quietly destroys the very margin it was supposed to build.

Break-Even elasticities: a simple, but powerful sanity check.

The Cannibalization Blind Spot

Promotions don’t happen in a vacuum. A successful-looking campaign often generates sales that are simply stolen from other parts of your own business, a phenomenon that most basic reporting fails to capture.

Forward-Buying: Particularly in B2B channels with predictable demand, customers simply buy product they would have purchased next month anyway to take advantage of the discount. This does little to increase total annual demand; it just pulls future, full-priced sales into the current, discounted period. This behavior wrecks demand forecasts, creates supply chain whiplash, and systematically destroys long-term margin for no real gain.

Portfolio Cannibalization: A deep discount on "Product A" doesn't just pull sales from competitors; it often pulls sales from your own "Product B" or "Product C," which may have higher margins. Without the ability to isolate true incremental volume for the portfolio as a whole, you’re often just shuffling sales between your own SKUs, but at a lower average price point and profit.

The Inevitable Spreadsheet Swamp

Let's be frank: even if a company wants to track these factors, its tools often make it nearly impossible. The default system for managing promotions is a disconnected web of spreadsheets—a classic “data rich, insights poor” environment. Finance has one version for accruals, Sales has another for tracking promotion results, and Marketing has a third for campaign planning. These manual, error-prone documents are completely static and incapable of providing a dynamic, all-in view of a promotion’s net impact. Accurately tracking true costs, netting out cannibalization, and calculating the incremental profit across dozens of overlapping regional and national campaigns in Excel isn’t just difficult; it’s a recipe for analytical failure and wasted time.

The Consequences of the Illusion

This inability to measure true promotional ROI damages the bottom line and creates unncessary friction between Finance and Sales teams.

Sales teams, armed with volume-based incentives, push for aggressive promotions to hit their sales goals, viewing them as essential tools. Finance, left staring at the declining margin reports without any context on ROI, views the sales team as undisciplined and financially reckless. Without a single source of truth to evaluate promotional investments, decisions devolve into political debates based on anecdotes and corporate lore. This erodes trust, paralyzes strategic decision-making, and triggers chaotic, "fire sale" discounting at the end of every quarter to "make the number."

Second, it damages the customer and channel partner experience in ways that are difficult to undo. When pricing is unpredictable and promotions are constant, you are systematically training your customers never to pay list price and to always wait for the next deal. This behavior is challenging to reverse and commoditizes your products. It also creates demand whiplash for your supply chain, leading to stockouts and service-level failures during promotions, followed by periods of costly excess inventory. You are, in effect, paying your customers to disrupt your operations and devalue your brand.

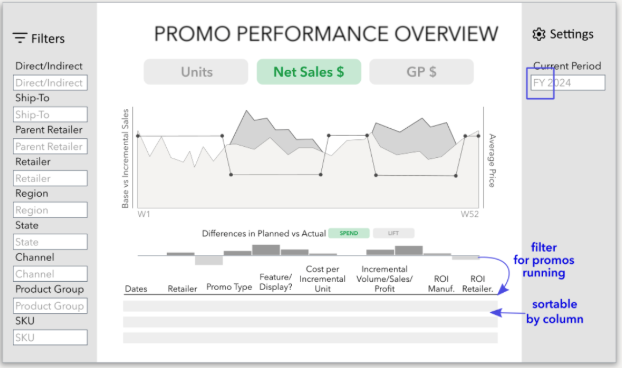

Sample Promotion Effectiveness Dashboard that measures ROIs for both manufacturers and channel partners down to the promotional event level.

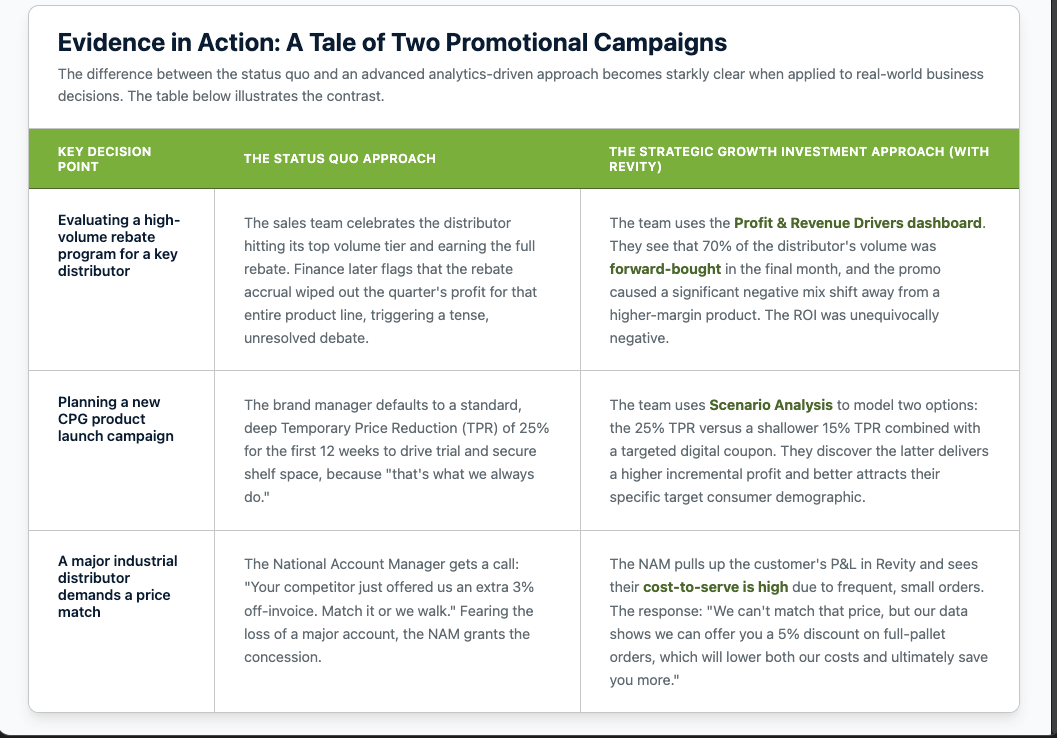

Promotion Analytics & Optimization

To escape this destructive cycle, a fundamental reframing is required. Promotions are not a marketing expense to be minimized; they are growth investments that demand rigorous analysis and optimization. The methodology to achieve this is Strategic Growth Investment Analytics, built on three core principles that directly counter the flaws of the status quo.

Shift the Goalpost from Revenue Lift to Incremental Profit. This is the foundational mindset shift. Instead of celebrating a temporary revenue spike, the primary goal is to calculate the true, net profit generated by the promotional investment after all associated costs—discounts, rebates, marketing materials, administrative overhead—are factored in. This moves the focus from a top-line vanity metric to the one that truly matters: bottom-line contribution and long-term value creation.

Isolate and Quantify True Incremental Volume. To calculate true profit, you must first understand true lift. This requires establishing a reliable, model-driven baseline of what sales would have been without the promotion. By using elasticity modeling to create this baseline, you can filter out the noise—the sales that were simply forward-buys or those that were cannibalized from other products in your portfolio. This crucial step isolates the volume that is genuinely new to the business, which is the only volume that should be credited to the promotional investment.

Establish a Single Source of Truth for Performance. The spreadsheet swamp must be drained and replaced with a unified, dynamic analytics platform. When Sales, Marketing, and Finance all work from the same real-time dashboard showing the performance of every promotional campaign, the entire dynamic of the conversation changes. The debate shifts from "Whose numbers are right?" to "How do we collaborate to improve our next investment?" This aligns the entire commercial organization around the shared goal of profitable growth and fosters a culture of accountability.

Revify as the Enabler

While the methodology is sound, it requires a purpose-built engine to execute. Revify is the Pricing and RGM Analytics as a Service platform designed to enable Promotion Analytics & Optimization for the mid-market. We provide the specific visibility and tools necessary to treat promotions as a measured investment.

To Measure Incremental Profit, Revify’s Profit & Revenue Drivers module automatically decomposes your performance. It shows your net margins' precise P&L impact of price, promotion, volume, cost, and mix. This provides an unequivocal, finance-approved view of a campaign’s true profitability.

To Isolate True Incremental Volume, our platform is engineered to establish clear sales baselines and execute accurate post-event analysis. It helps you analyze forward-buying and cannibalization to understand the actual lift generated by your promotional spend, ensuring you're rewarding real growth, not just subsidizing shifted demand.

To Establish a Single Source of Truth, Revify serves as the central hub for all Pricing Analytics performance data. Going beyond just descriptive and diagnostic analytics, our Scenario Analysis module allows for proactive planning. Before you invest a single dollar, you can model the likely financial impact of different discount levels or rebate structures using sophisticated elasticity modeling, and choose the path that delivers the highest projected incremental ROI.

Sample Scenario Analysis mockup that allows companies to simulate various Promotional offers and understand the business impact.

Sample Scenario Analysis mockup that allows companies to simulate various Promotional offers and understand the business impact.

Overcoming the Hurdles

Migrating to an insights-driven methodology is relatively straightforward from a data, analytics and technical standpoint. Change management and overcoming internal inertia is perhaps the more challenging part. Some objectctions we’ve heard from Commercial and Finance teams (that we’ve addressed with the Revify platform):

Objection 1: "Our promotional structures are too complex and our data is a mess."

This is precisely the problem that modern analytics platforms are built to solve. The complexity is the disease; a unified platform is the cure. To think you must perfectly clean all your data before you can get insights is a fallacy that leads to inaction. Our rapid implementation process—often delivering initial insights in just 1-2 weeks—is designed to find the signal in the noise, integrating data from your ERP and CRM to build a coherent picture without requiring a massive, disruptive IT project.

Objection 2: "We can't afford an expensive, dedicated TPO platform."

This is a common misconception, born from the era of monolithic, six- and sometimes seven-figure enterprise software. Revify is built specifically for the mid-market, with transparent, subscription-based pricing designed to deliver an ROI that far exceeds the cost. The more critical question is: can you afford to continue guessing on 15% of your gross revenue? The cost of inaction—the hidden profit leakage from just one or two bad promotions—is almost always greater than the investment in visibility.

Objection 3: "Our sales and marketing teams need flexibility; this sounds too restrictive."

This isn't about restriction; it's about empowerment. The goal is not to eliminate promotions or discounts but to make them smarter. Providing a salesperson with clear data on which offers create the most value for both the customer and the company elevates them from an order-taker to a strategic partner. It gives them the tools to craft more profitable deals and the confidence to defend value, shifting the conversation from "What discount do you need?" to "How can we create the most profitable outcome together?"

Objection 4: "This sounds great, but we don't have the internal expertise to manage it."

This is perhaps the most common reality in the mid-market. Most firms don't have a dedicated team of RGM analysts or data scientists. This is why the "as a Service" component of a modern solution is so critical. The right partner doesn’t just hand you software and a user manual; they provide the expertise to interpret the findings and guide the strategy. At Revify, our model includes regular consultative reviews with RGM experts precisely to fill this capability gap, ensuring the analytics translate into actionable, profit-driving initiatives.

Objection 5: "We need quick wins, not a massive 'boil the ocean' transformation."

This fear is completely justified, often born from past experiences with enterprise software projects that promised the world and delivered a year later with questionable results. A modern approach flips that script entirely. The goal is not to boil the ocean but to find the hottest part of the water—fast. Our deployment focuses on identifying the 2-3 biggest sources of promotional profit leakage within the first few weeks. This generates immediate momentum, builds internal credibility, and often provides the ROI to fund the entire journey forward.

Stop Guessing, Start Investing

The “Promotional Illusion”—the belief that all activity is good activity—is quietly and consistently eroding profit margins across industries. The relentless pressure from competitors and channel partners is partly to blame; but the bigger issue is the lack of disciplined, insights-driven approach to managing trade spend as a strategic portfolio of investments.

By shifting your methodology and your mindset, you can move from a state of reactive, defensive spending to one of proactive, profitable growth. The opportunity cost of remaining in the dark is simply too high to ignore. It's time to turn on the lights.

Ready to uncover the hidden ROI in your trade spend? Request a consultation to see how Revify can transform your promotional strategy from an expense into a powerful profit engine.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.