Modeling Price Elasticity of Demand - A Strategic Brief for Pricing Leaders

Many executives are familiar with the concept of “price elasticity of demand,” but it is often misapplied within organizations, leading to significant business impacts. The 2025 Revenue Growth Analytics Maturity Report from Revology Analytics, which examined nearly 2,000 companies, found that a 1% improvement in net price realization results in a median 6.4% increase in operating profit. In some sectors, the impact is even greater: 17.4% in Automotive and 9.2% in Consumer Staples. However, 63% of companies cannot measure promotional ROI, and more than half remain at a 'Medium' maturity level due to poor data, misaligned incentives, and gaps between strategy and execution.

This guide is intended for leaders in pricing, Revenue Growth Management, finance, and commercial analytics who require data-driven, defensible pricing decisions. It also includes links to additional Revology resources on estimating price elasticities and selecting data to enhance your models.

What is Price Elasticity of Demand?

Price elasticity of demand (PED) measures how much demand changes when the price changes:

PED = (% change in quantity demanded) / (% change in price)

In most markets, own-price elasticity is negative. When prices increase, units sold typically decrease. For example, a PED of -0.4 means a 1% price increase results in approximately 0.4% fewer units sold (inelastic). A PED of -1.5 means a 1% increase leads to about 1.5% fewer units sold (elastic). Understanding elasticity links pricing decisions to expected changes in volume and margin, improving scenario planning reliability.

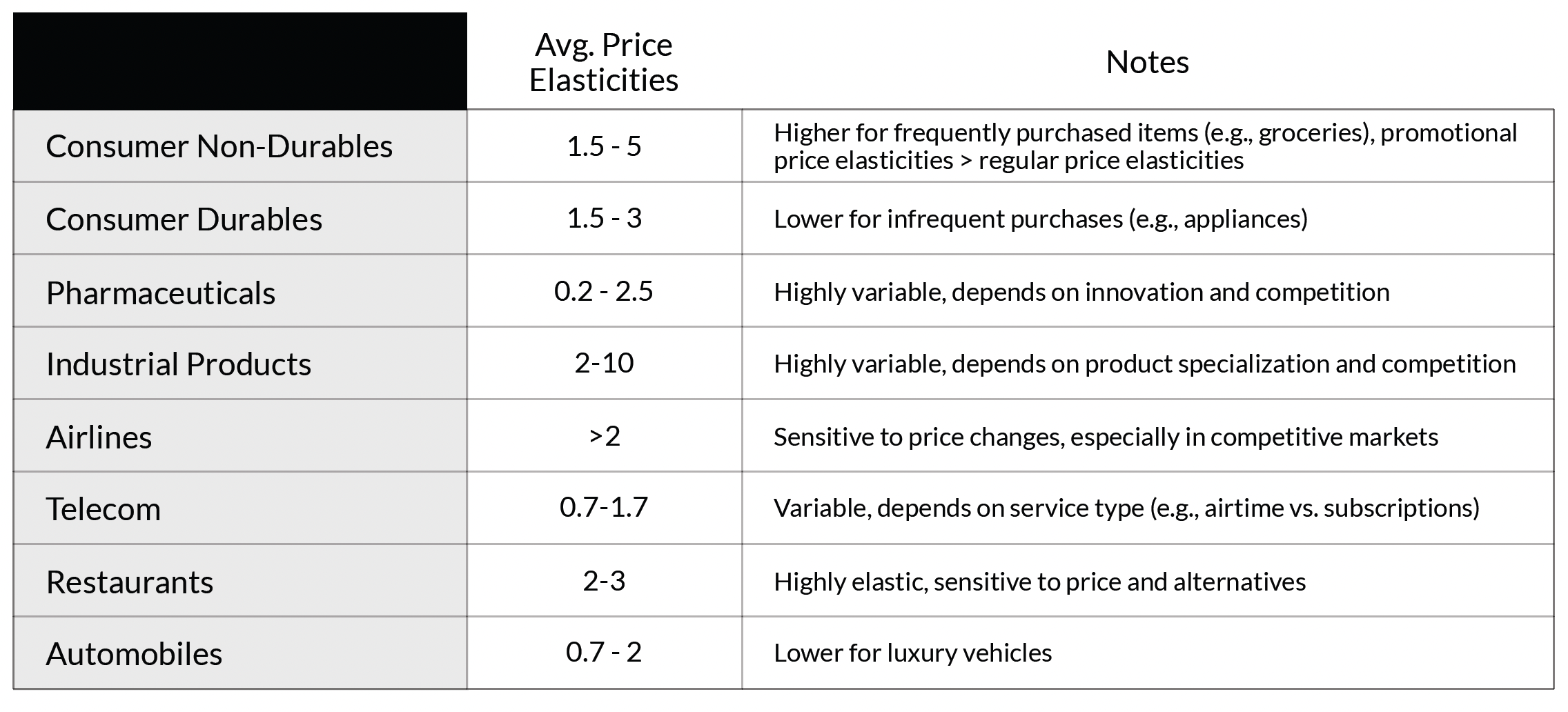

Typical price elasticities by industry.

Why Elasticity Work Fails Inside Companies

A common mistake is relying on 'Spreadsheet Elasticity.' This occurs when someone compares two periods, calculates the percentage change in volume and price, divides, and labels the result as 'the elasticity.' This method overlooks critical factors such as marketing, distribution, seasonality, competition, and promotion timing. For example, Revology's internal research in an emerging market initially showed an unrealistic elasticity of approximately +24 using this approach. When marketing and distribution effects were included, the true elasticity was closer to -0.44.

The five main reasons elasticity analyses fail:

Price moves are confounded: list price changes coincide with distribution gains, media bursts, or competitor outages.

Promo calendars overwhelm the signal: when 50-60% of volume is promoted, regular price elasticity can become nearly undetectable.

Net price reality is overlooked: list price changes are recognized, but the customer's actual price paid does not change.

Channel mix changes can be mistaken for elasticity: as direct-to-consumer grows and retail declines, aggregation can obscure the true effect.

Competitive response is missing—without cross effects, you attribute substitution to your own elasticity.

How to Calculate Price Elasticity of Demand

The Basic Formula

Example: Price rises from $10 to $11 (+10%), units fall from 1,000 to 900 (-10%). PED = -10%/+10% = -1.0

Midpoint (Arc) Elasticity

Business data is often inconsistent. The midpoint method reduces errors by averaging two points. Use this method if you have clear price changes, need a stable estimate across a price range, or require an explanation that is easy to communicate. For more details, see Revology's article on estimating price elasticities.

Advanced Elasticity Estimation Methods

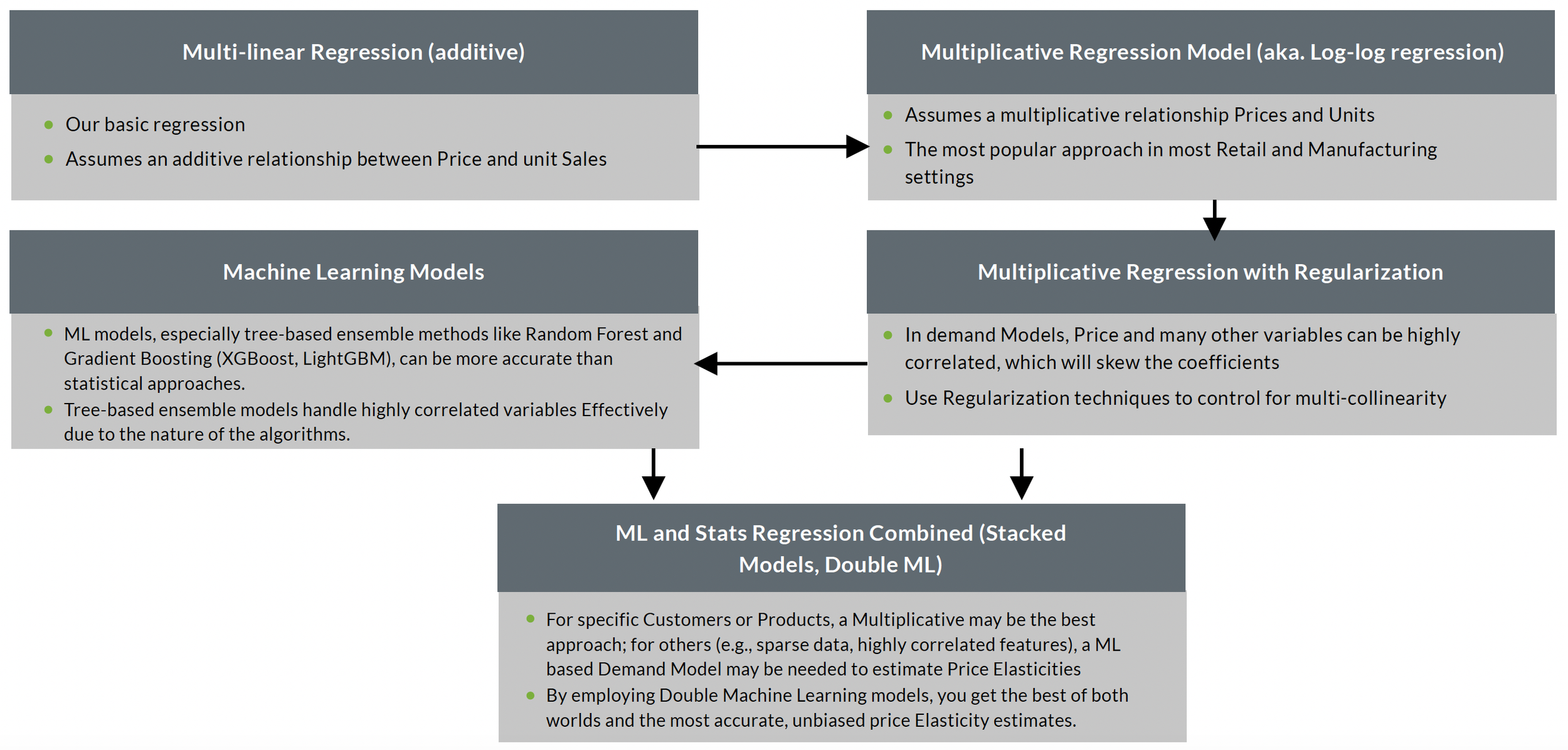

Log-log regression models are a common way to estimate elasticity because the coefficient directly shows elasticity. This method works well when demand changes in proportion to price. However, it can give misleading results if the price is affected by other factors or if important variables are missing.

Double machine learning (DML) is useful when pricing responds to demand, such as discounting during slow periods. Standard regression does not work well in these situations. DML first predicts price and volume using known factors, then uses the remaining variation to estimate the real effect of price changes.

Hierarchical shrinkage is useful when you have many products but not much data per product. Also known as Empirical Bayes, this method uses information from similar products to improve your estimates. Sparse items are adjusted toward their group average, which helps prevent extreme or unstable results.

Validation frameworks are essential. Do not use elasticity estimates directly from a model to set prices. Instead, assess whether the results are reasonable by applying appropriate limits, and test for stability by excluding one quarter at a time to verify consistency. For more details, you can download our price elasticity modeling guide.

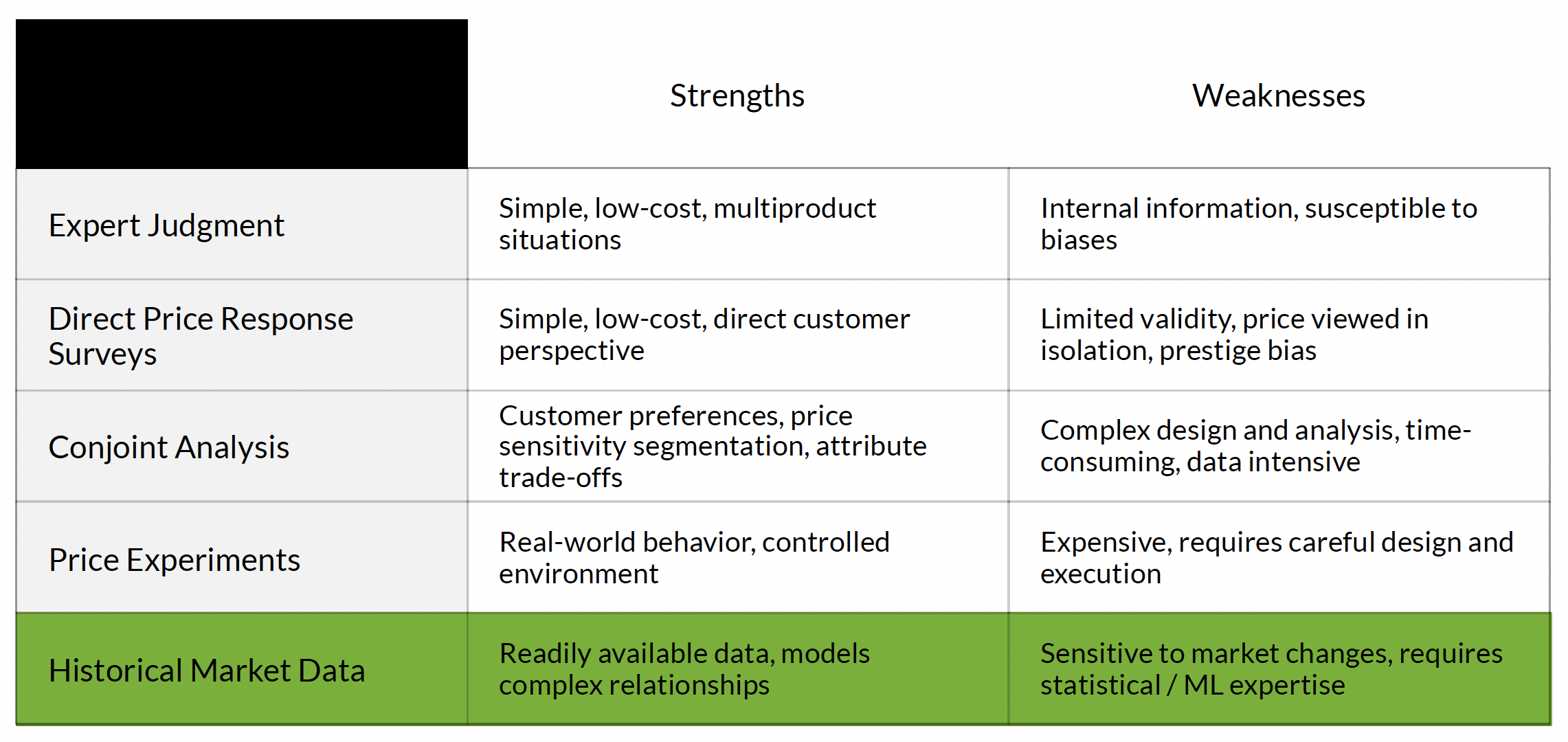

Other popular price elasticity estimation methods.

Interpreting Price Elasticity Values

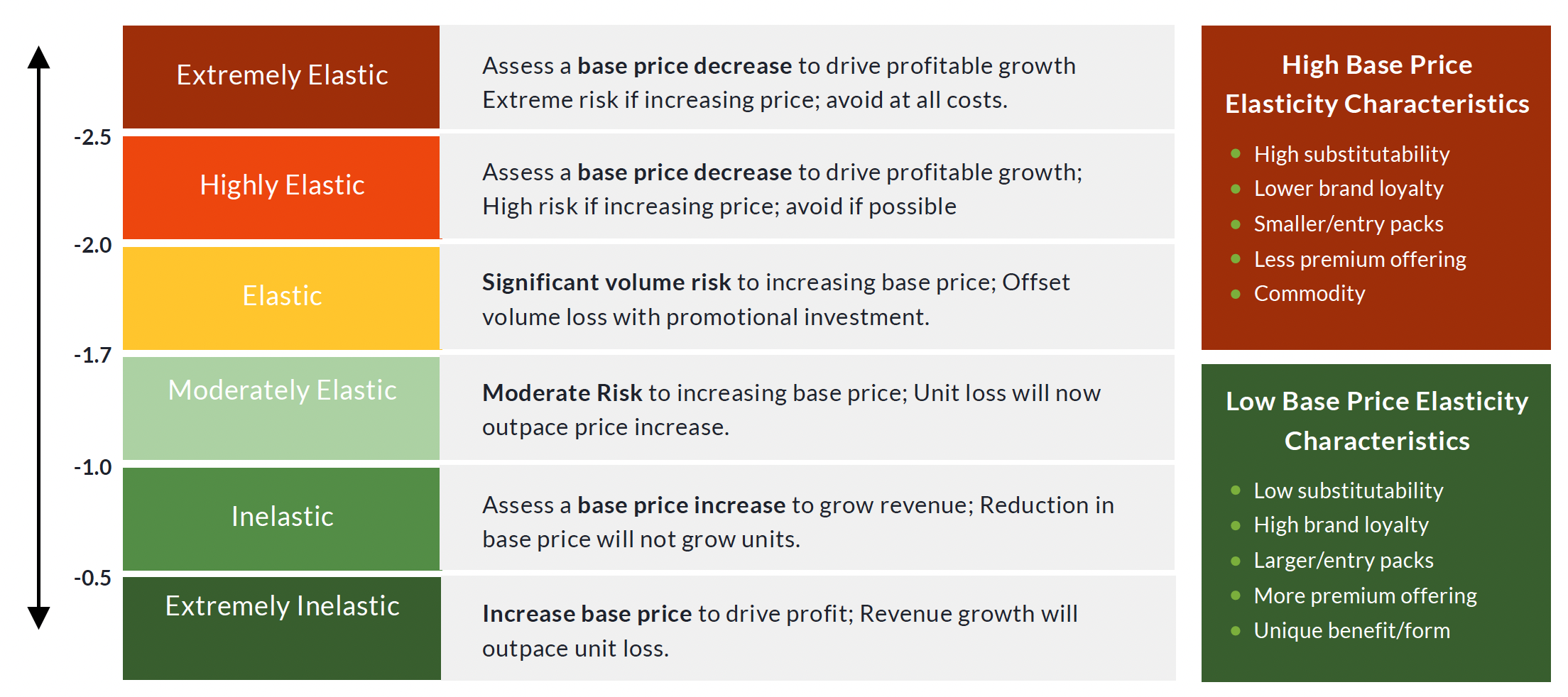

Elastic demand (|PED| > 1): Demand is sensitive. Price increases need segmentation and value defense; competitor moves can hurt quickly.

Inelastic demand (|PED| < 1): Demand is less sensitive. Price increases are often the cleaner margin lever; promotions may be better used for trial than 'buying volume

Promotional price elasticity is often 1.5 to 2 times higher than regular price elasticity in many categories. Do not use elasticity measured during promotions to determine your regular list price range.

Base Price Elasticity Strategy Guide

Cross-Price Elasticity and Competitive Dynamics

Own elasticity measures the impact of your price changes, while cross elasticity measures the effect of competitor price changes. Cross-price effects can be difficult to measure, so a common guideline is that cross elasticity should not exceed 80% of your own elasticity. Some teams use a competitive price index with defined ranges for each segment to maintain market position.

Factors That Influence Price Elasticity

Elasticity depends on both the market context and the product itself. Key factors include the number of substitutes, switching costs, customer loyalty, share of wallet, time horizon, channel sensitivity, and the reference price effect. Customers respond to price changes based on a reference point rather than the absolute price.

Using Elasticity in Pricing and Revenue Management

Setting Strategic Price Increases

Elasticity is most valuable when applied to P&L scenarios. For example, consider a $100 product with a $70 unit cost and a baseline of 10,000 units:

If you increase the price by 2% and elasticity is -1.2, the new price becomes $102, volume decreases to 9,760 units (down 2.4%), and revenue declines by approximately 0.45%. However, gross profit increases by about 4.1%. This demonstrates why pricing leaders focus on elasticity and its impact on gross profits, not just revenue.

Three-Tier Deal Envelopes

Sales teams can leverage elasticity within clear deal structures: Floor (the lowest price allowed without senior approval, based on contribution margin), Base (the standard price based on segment economics), and Ceiling (the highest price for less price-sensitive segments). Monitor net price realization. If the list price increases but discounts also rise, the intended price increase may not be achieved.

What Happens Without Knowing Your Elasticities

Price changes often prompt debate. Sales teams are concerned about losing deals, finance seeks higher margins, and leadership aims to balance both. The 2025 Revenue Growth Analytics Maturity Report found that companies with strong executive support for pricing have maturity scores over 17 points higher than those without it. Without incorporating elasticity, pricing decisions are delayed, exceptions increase, and the company often defaults to discounting.

Trade promotion strategies fail when discounts are poorly allocated and pass-through is inconsistent. Research from Strategy& (PwC) found that the median return on trade dollars spent was -29% in a consumer products study. This reflects a classic prisoner's dilemma: no one wants to be the first to stop promoting, even when the return on investment is poor.

From linear methods to more advanced ML models to estimate price elasticities.

What Decision-Grade Elasticity Looks Like

A useful elasticity capability has three traits:

Technically defensible: controls, causal reasoning, stability checks

Commercially translated: price corridors, promo guardrails, scenario outputs tied to margin dollars

Operationally adopted: governance, cadence, exception workflows.

The 2025 Revenue Growth Analytics Maturity Report reveals why most organizations struggle to achieve this. While Pricing Analytics & Optimization shows the highest relative maturity among RGA capabilities (64% at High or Very High), the execution details expose critical gaps in elasticity work, specifically:

Elasticity measurement cadence is a clear differentiator: Organizations that update price elasticities semi-annually or quarterly achieve significantly higher PA&O maturity scores than those with annual or ad-hoc refreshes. As the report notes, "action happens while the data is warm."

Promotion ROI remains a blind spot: 63% of companies cannot quantify promotion ROI - a calculation that fundamentally requires reliable elasticity estimates to separate baseline demand from promotional lift.

Dynamic pricing adoption is limited: Only ~15% of companies have dynamic pricing capabilities, which depend on elasticity models to automate price responses to demand signals.

At Very High maturity, best-in-class firms employ ML-enabled elasticity simulators embedded in BI or other dynamic dashboards to test "what-if" pricing moves before execution. They conduct price realization analysis at least monthly and refresh elasticity models quarterly for priority SKUs.

Without this foundation, organizations "cannot react nimbly to market changes", making them vulnerable to more data-savvy competitors and unable to capture the 6.4% median operating profit improvement that a 1% price gain can deliver.

A Practical Next Step

To assess your current assumptions, select one category or business unit. Validate elasticity using controls and stability checks. Develop three to five price scenarios linked to margin dollars, and ensure this guidance is integrated into deal workflows, not just presentations.

If you need assistance building a robust elasticity capability, Revology’s Pricing & Revenue Growth Management team can support you. Potential outcomes include up to 10% higher operating profits, up to 15% more gross profit, and up to 50% improvement in promotional ROI.

───────────────────────────────────────────────────

FAQs

What does price elasticity of demand measure? It measures the percentage change in demand (units) for a given percentage change in price.

How do you calculate price elasticity of demand? Use PED = (%ΔQ)/(%ΔP). For a rough estimate, midpoint (arc) elasticity is often a good starting point; otherwise, more complex statistical/econometric/machine learning methods are appropriate.

What does an elasticity of -1.5 mean? A 1% price increase is associated with roughly a 1.5% decrease in demand.

Why is my calculated elasticity showing a positive sign? A positive own-price elasticity is economically implausible and usually signals the presence of confounding variables. Use econometric controls or DML-style methods to isolate causal price impact.

How do I handle elasticity estimation with limited data? Use hierarchical shrinkage (Empirical Bayes) to pool sparse items toward family- or category-level means.

Why do so many trade promotions have negative ROI? A 'prisoner's dilemma' dynamic (fear of losing share), weak measurement, and inconsistent pass-through. Most Promotions in the CPG space have a negative return.

Subscribe to

Revology Analytics Insider

Revenue Growth Analytics thought leadership by Revology?

Use the form below to subscribe to our newsletter.